ARES Urbanexus Update #149

This selection of real estate and community development news and information began publication in 2018. It is now distributed by the American Real Estate Society (ARES). Its founder, H. Pike Oliver, continues as curator, and the update is distributed free of charge.

Environment

A strong warning on carbon emissions and climate change

The latest (March 2023) report from the Intergovernmental Panel on Climate Change (IPPC) of the United Nations highlights devastating effects in many parts of the world. This includes extreme weather events such as heatwaves, droughts, and floods, which have resulted in the loss of lives, homes, and ecosystems. The report warns that these changes are becoming increasingly irreversible and could have catastrophic consequences if there is no immediate action to limit global temperature rise to 1.5C above pre-industrial levels.

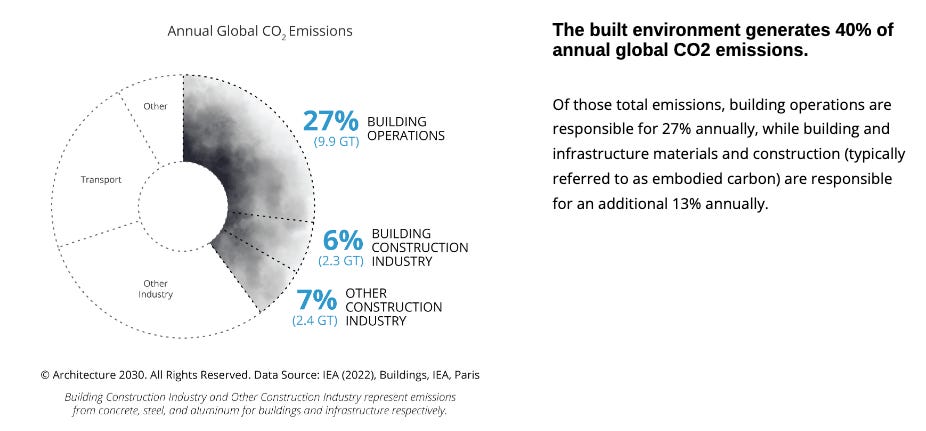

Learn more here, and note that according to Architecture 2030, the built environment generates about 40% of annual global carbon emissions, as highlighted in the chart below.

Finance

Turmoil in the bank sector causing frayed nerves

Earlier this month, the Federal Deposit Insurance Corp. (FDIC) took the reins at two regional banks, Silicon Valley Bank based in Northern California and New York City-based Signature Bank. According to the FDIC, 2023 already represents the largest year in bank failures in terms of total assets ($319.4 billion combined between the two banks) since 2008, when 25 banks failed (representing $373.6 billion in total assets).

Data from Trepp, a leading provider of information to finance and commercial re estate, shows that $270 billion of bank commercial real estate loans are maturing in 2023, which is an all-time record year for loan maturations. This “debt wall” is concerning because a high point in commercial real estate lending has been a precursor to recessions in previous economic cycles.

Near-term loan maturities, or loans maturing in the next 24 months, that have a debt-service coverage ratio (DSCR) below 1.25 total a little over $70 billion. This is a big leap from mid-October 2022, when Trepp data showed that figure at $53 billion.

Learn more here.

Commercial borrowers seek flexibility amid volatility

In the wake of rising interest rates, borrowers are looking for outside-the-box solutions to reshape their capital stacks to reduce the impacts of numerous interest rate hikes. For those that can afford to do so, the simplest solution is: just to sit tight.

Borrowers unable to simply “wait it out” must be willing to accept equity infusions or shifts to short-term debt structures. That means giving up a percentage of ownership of an asset or paying higher interest rates.

Being flexible in the short term could save millions in interest payments later down the line. Outside of those basic avenues of relief, borrowers have little recourse but to sell their properties, presumably at discounted prices in some cases. Otherwise, they risk defaulting on their loans and possibly going into foreclosure.

Learn more here.

U.S. banks are missing hundreds of billions of dollars

Deposits in banks are falling. Over the past year, those in commercial banks have sunk by half a trillion dollars, a fall of nearly 3%. This makes the financial system more fragile since banks must shrink to repay their deposits. Where is the money going?

The answer begins with money-market funds, low-risk investment vehicles that park money in short-term government and corporate debt. Such funds, which yield only slightly more than a bank account, saw inflows of $121bn while Silicon Valley Bank failed. According to the Investment Company Institute, they had $5.3trn of assets in March, up from $5.1trn a year before.

Learn more here.

What is GNMA, and what does it do?

The Government National Mortgage Association (GNMA, say “Ginnie Mae”) is a government corporation within the U.S. Department of Housing and Urban Development (HUD). It was established in 1968 when Fannie Mae was privatized. Its mission is to expand funding for mortgages that are insured or guaranteed by other federal agencies. When these mortgages are bundled into securities, Ginnie Mae provides a full-faith-and-credit guarantee on these securities, thus lessening the risk for investors and broadening the market for the securities.

Learn more here.

Office

North America has the lowest return of workers to the office

Bigger homes, longer commutes and a tighter labor market help explain why Americans spend less time in the office than Europeans and Asians, workplace consultants say.

Learn more here.

Some offices might become housing in San Francisco

San Francisco is one of the prime examples of downtowns in need of conversions from office-centric to housing-rich. As documented by recent articles, it’s not easy to convert office buildings to residential units, though there’s a major potential benefit to identifying the kinds of buildings that can be converted.

A new study of office conversion feasibility by the San Francisco Planning and Urban Renewal Association (SPUR) and the local Urban Land Institute chapter is detailed in a paywalled article by John King for the San Francisco Chronicle. The analysis “suggests more than 10,000 housing units could be created within the shells of older office buildings — but only if the city primes the pump by lowering fees and affordable housing requirements,” reports King.

Learn more here.

Retail

Retail during and following the onset of the pandemic

In 2022, apparel retailers saw the second-highest number of brick-and-mortar store openings in the US — a total of 1,395. Many of them were in the suburbs. Meanwhile, retail stores’ footprints are shrinking in major cities like San Francisco and New York as companies abandon malls and large-format stores in downtown areas in favor of residential neighborhood locations that serve the new generation of remote workers.

Learn more here.

Metropolitan and regional dynamics

Covid-19 sparked a downtown exodus in major cities

Major downtowns across the U.S.A. saw a stream of businesses close or change their addressees to non-downtown ZIP codes in the three years since the pandemic began. It turns out that sunbelt cities have weathered the storm the best. That’s one big takeaway from an analysis of change-of-address U.S. Postal Service data by The Business Journals.

Learn more here.

A slow pandemic recovery in the San Francisco Bay Area

The COVID-19 recovery in San Francisco and the East Bay of the Bay Area is one of the worst among major metropolitan areas, according to an economic recovery tracker launched by the Bay Area Council, a business group. Pandemic recovery was measured via 15 different metrics, including local job growth, population growth, office occupancy, labor force growth, sales tax receipts, and the construction of new housing. The Bay Area Council’s Economic Institute developed the Regional Economic Recovery Index in partnership with CBRE and its Tech Insights Center.

Among the 25 largest metro areas in the U.S.A., ranked by regional gross domestic product, the San Francisco metropolitan area pandemic recovery ranked 24th, besting only Baltimore. To the south, San Jose and other cities in the southern part of the Bay Area fared better but are still in the back half of the ranking at 16th. The Austin, Dallas, and Denver metro areas have had the greatest recovery to date.

Lee Ohanian of the Hoover Institution at Stanford University points out that no major North American city has lost people to the same extent as the City of Detroit, where the population dropped from 1.85 million people in 1950 to about 630,000 today. But here comes the City of San Francisco, which lost 6.3 percent of its population between 2019 and 2021, a rate of decline larger than any two year-period in Detroit’s history and unprecedented among any major US city.

Learn more here.

Can Seattle reinvent its downtown?

Remote work is probably here to stay, so it’s unlikely offices in downtown Seattle will ever be filled to capacity again — and the decreased daily worker traffic will impact, perhaps permanently, the businesses that depended on their presence. Crosscut city reporter Josh Cohen has been speaking with city leaders, urban planners, real estate professionals, business owners, workers, and even Crosscut readers to take stock of a post-pandemic downtown: not only what the impact of these past few years has been, but what the central business district’s future could look like. His podcast with Sara Bernhard of Crosscut Reports is available here.

Residential

More built-for-rent than build-for-sale

As reported in the CalculatedRisk Newsletter, the graph below shows the quarterly intent for four housing start categories since 1975: single-family built for sale, owner built (includes contractor built for owner), starts built for rent, and multi-family built for sale. Single-family starts built for sale (red) were down 34% in Q4 2022 compared to Q4 2021. And owner-built starts (orange) were down 10% year-over-year. Multi-family built for sale decreased and is still low. The 'units built for rent' (blue) and were up 15% in Q4 2022 compared to Q4 2021. For the first time since this series started in 1974, there were more units built-for-rent started in Q4 2022 than single-family units built-for-sale started.

Baby boomers overtake millennials in home buying

Millennials are no longer the top generation buying homes, as a rapid increase in mortgage rates and other factors have sidelined a lot of first-time buyers since last spring and summer.

In its latest demographic report, the National Association of Realtors found that baby boomers, ages 58 to 76, last year made up 39% of homebuyers, an increase from 29% in 2021. Millennials, who are now 24 to 42 years old, had been the dominant homebuying generation prior to 2022 but last year made up 28% of homebuyers, quite a decline from the 43% observed in 2021.

Learn more here.

Mixed-use

Eight-acre project in Chicago’s Woodlawn neighborhood

Woodlawn Central LLC is moving forward with the development of Woodlawn Central, an $895 million mixed-use project spanning eight acres in Chicago’s Woodlawn neighborhood. The development team recently hired Transwestern Real Estate Services as its commercial real estate services provider.

The goal of Woodlawn Central is to transform the area into a walkable, transit-oriented district with easy access to civic amenities such as the Obama Presidential Center, Jackson Park, the Museum of Science and Industry, and the University of Chicago. Woodlawn’s Apostolic Church of God conceived and planned the project. The Network of Woodlawn, which was founded in 2009 to improve the neighborhood’s quality of life by building infrastructure to support better education, safety, health, and economics, gave substantial input on the project.

Learn more here.