ARES Urbanexus Update #150

This selection of real estate and community development news and information began publication in 2018. It is now distributed by the American Real Estate Society (ARES). Its founder, H. Pike Oliver, continues as curator, and the update is distributed free of charge.

Real estate economics and finance

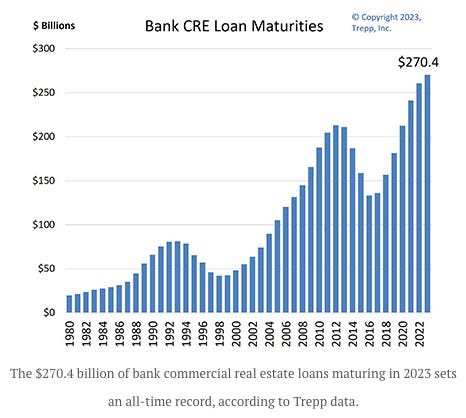

Commercial real estate and banking

Apartment building sales in the first quarter of 2023 posted the steepest drop since the Great Financial Crisis, signaling that a corner of the commercial real estate market is feeling the strain of tighter lending standards by banks and interest rates rising from historic lows.

Market observers have been warning commercial real estate could be the next shoe to drop after the fall of Silicon Valley Bank. That's because many small and medium-sized banks have large exposure to commercial real estate via loans on their balance sheets. In a tighter credit environment, these banks may be less willing to lend on commercial property, and those borrowers that can refinance will be doing so at much higher rates. Learn more here.

Office

Stress builds as owners and lenders haggle over debt

A real estate investment fund recently defaulted on $750 million of mortgages for two Los Angeles skyscrapers. A private equity firm slashed the value of its investment in the Willis Tower in Chicago by nearly a third. And a big New York landlord is trying to extend the deadline for paying down a loan for a Park Avenue office tower.

Office districts in nearly every U.S. city have been under great stress since the pandemic emptied workplaces and made working from home common. But in recent months, the crisis has entered a tense phase that could damage local economies and cause financial hits to real estate investors and scores of banks. Learn more here.

How offices have looked over the last 100 years

A look back on how offices have evolved over the last century provides context as architectural and interior design firms reimagine the physical workplace to accommodate the hybrid approach to work that was accelerated by the pandemic as well as evolving technology. There are reconfigured meeting rooms with conferencing technology, amenities and aesthetics that resemble those at fashionable hotels and coffee shops, and seating layouts based not on headcount but on how often each worker comes in. Learn more here.

Retail

Consumers prioritize food and personal care items

Per Marcus and Millichap, overall retail sales have dropped in the U.S.A. However, a pair of necessity-based categories continued to record gains. In March 2023, health and personal care shops registered a third consecutive month of growth, with sales rising 0.3 percent. Meanwhile, grocery store purchasing increased slightly amid a decline in food-at-home inflation.

The divergence between these two segments' performance and overall retail spending indicates consumers are placing larger importance on essential goods and passing on big-ticket items. Consumers that are still looking to make discretionary purchases may be spending online where discounts exist. Online pricing fell 1.7 percent year-over-year in March, with 10 of 18 major product categories experiencing declines. Learn more here.

Navigating a changing mall

Over the past couple of years, many analysts have asserted that shopping centers have lost their relevance. But visits have not dropped as dramatically as predicted, and in 2022, despite the various economic headwinds, shopping centers throughout the country still attracted hundreds of millions of visits. Learn more here.

Hospitality

Hotel trades are down, but prices per room are up

Daniel Lesser of LW Hospitality Advisors reports that the current relatively high cost of debt has widened bid/ask spreads for hotel properties and clearly slowed investment volume. Despite relatively high debt costs and tightening lending standards, strong room rate growth continues to fuel the positive momentum of U.S. lodging industry operating metrics. And notwithstanding the relatively high cost of airfares and hotel rooms, the pace of travel continues to be robust, led by strong leisure demand and increasing amounts of corporate group and individual patronage. Learn more here.

Housing

The “Builder’s Remedy” in California

The builder’s remedy is a 1990 law that allows developers to circumvent local building rules if the city is out of compliance with state housing law and if a residential development meets certain affordability requirements. Developers have long had the ability to invoke the law, but according to law professor Chris Elmendorf, many have only recently been willing to use it. This is due, in part, to newly passed legislation and growing concern about the state’s housing crisis. Learn more here.

Mixed-use

Park Central Mall in Phoenix becomes a medical hub

A sea of asphalt parking lots is giving way to a new medical school, more than 600 apartment units, a new hotel, and the biggest parking garage in Arizona, with plans for more development still to come. It's a sharp turn from a few years ago, when the mall was mostly vacant, creating a void of activity in the center of Phoenix. Learn more here.

More than 1,100 homes to flank a mall in Southern Califonia

Yesterday, Shopoff Realty Investments announced plans to redevelop a portion of the Westminster Mall, which flanks the 405 freeway at the intersection of Bolsa Avenue and Edwards Street, and the 405 Freeway in Orange County. The approximately 26-acre development, dubbed Bolsa Pacific at Westminster, would replace a Macy's department store and a shuttered Sears, which bookend the mall.

Plans call for the construction of three new apartment buildings, totaling 1,065 residential units, as well as 102 for-sale townhomes. Other components of the project include a 175-room hotel and approximately 25,000 square feet of shops and restaurants - including a food hall.

Regional and metropolitan area trends

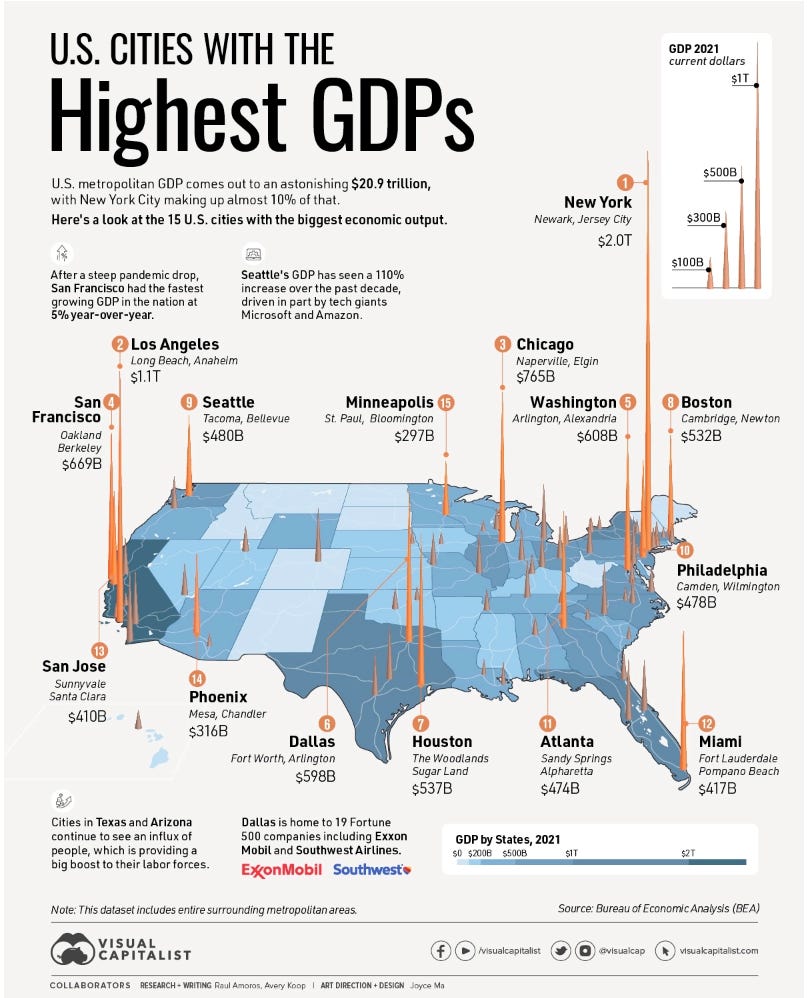

U.S. Metropolitan areas with the largest GDPs

The United States has the largest GDP in the world in nominal terms, and urban areas are a major contributor to the country’s economic might. In fact, metropolitan areas account for roughly 90% of U.S. economic output.

In this visual Visual Capitalist ranked the gross development product (GDP) of the top 15 U.S. cities from New York City to Minneapolis, using data from the U.S. Bureau of Economic Analysis. The data covers 2021, which is the most recent release from BEA.

It’s important to note that the data considers entire surrounding metropolitan areas, so as an example, New York City includes neighboring population centers such as Newark, NJ, as well as Jersey City—reaching a GDP of nearly $2 trillion.

Measuring a city’s economy at the metro level can provide a more accurate representation of its economic activity. This is because the metropolitan areas include not only the central city but also the surrounding suburban and rural areas that are economically connected to it. Learn more here.

Why urban exodus narratives may be wrong

The Census Bureau has published two population estimates that say cities are losing people fast. But factoring in the margins of error on their data changes the story entirely. Learn more here.

Construction

Construction spending in 2023

Per Ed Zarenski, construction Spending through February 2023 is up 5.9% year-to-date. Spending is forecast to finish in 2023 up 5.3%. While residential is likely to fall back nearly 7% in 2023, Nonresidential buildings are leading with a forecast of 20% spending growth. Learn more here.