ARES Urbanexus Update #151

This selection of real estate and community development news and information began publication in 2018. It is now distributed by the American Real Estate Society (ARES). Its founder, H. Pike Oliver, continues as curator, and the update is distributed free of charge.

Real estate investment

Market conditions in North America

According to commercial real estate brokerage and real estate services firm Lee & Associates, the first quarter of 2023 saw:

a sharp decline in demand for industrial space

a continued decline in tenant demand for office space that went from bad to worse

an easing in overall net absorption of retail space, but an improvement in supply-demand fundamentals

continued slowing in multifamily rental rent growth

Learn more here.

Interest rate hikes

After the latest rate hike on May 2023, U.S. interest rates have reached levels not seen since 2007. The Federal Reserve has been aggressive with its interest rate hikes as it tries to combat sticky inflation. In fact, rates have risen nearly five percentage points (p.p.) in just 14 months.

This graphic—inspired by a chart from Chartr—compares the speed and severity of current interest rate hikes to other periods of monetary tightening over the past 35 years.

Retail

Reimagining retail spaces

Although garnering less attention than office, retail conversions are just as prominent and arguably present a more dynamic conversion opportunity, one that many owners and developers considered before the COVID-19 pandemic. And unlike office, retail conversions provide a greater range of opportunities. While we are still waiting for the office market to play out, there are already opportunities in the retail sector brought about by isolated instances of turmoil among key retailers, such as Bed Bath & Beyond. RCLCO has highlighted eight types of retail conversions across the United States worth considering. See examples here.

Nordstrom in San Francisco

According to Jamie Nordstrom, the company's chief stores officer, retail giant Nordstrom plans to close its 312,000-square-foot department store in downtown San Francisco, citing changing dynamics downtown. Learn more here.

Hospitality

Slow recovery among upper-upscale hotels

There's a growing correlation between a certain segment of the hotel market — upscale business-oriented hotels in central business districts — and office market activity in a given city. That's according to a recent analysis by CoStar Group Inc. (Nasdaq: CSGP), which found as more companies scale back office footprints and attendance requirements, travel to those markets has been impacted, too. Learn more here.

Master-planned communities

Observations on U.S. new towns

Wendell Cox, a transportation consultant and a leading critic of urban planning policies, recently offered some insights on large new town developments. These large-scale developments were initiated in the middle of the 20th century when there was considerable interest in developing new communities (new towns). The interest was somewhat driven by establishing new towns in nations like the United Kingdom and France, where several were completed by 1970.

There was great hope for new communities. In the late 1960s, the National Committee on Urban Growth Policy recommended building 100 new communities of 100,000 residents each and 10 new towns of 1,000,000 residents. In the end, few were built, including four discussed in this article (The Woodlands, TX; Columbia, MD; Reston, VA; and Highlands Ranch, CO), as well as Irvine, CA. Among these, only Reston failed to achieve a population of 100,000 or more. Only Irvine has been incorporated as a municipality. The other four are census-designated places (CDPs).

Urban planners have favorably reviewed The Woodlands and other new communities. An evaluation by Ann Forsyth, now at Harvard University, published in 2005 noted that The Woodlands (as well as Columbia, Maryland, and Irvine, California) conform to the “smart growth” and some of the “new urbanist” design practices that are generally favored in urban planning, exhibiting “cutting-edge planning and design strategies.“ This is despite their suburban locations, which the planning community has long disdained.

Total self-sufficiency was not achieved in any of these places, but there was considerable growth in local employment. For example, among the five new towns mentioned in this article, Irvine is, by far, the largest and had the highest percentage of working residents employed within its borders (45.3%), according to American Community Survey 2015-2019 data, while Highlands Ranch has the lowest share, at 27.5% (Figure 1). Learn more here.

A lot of rules appeal to wealthy buyers

White walls and roofs are among the requirements that create the unusual aesthetic of Alys Beach, a 158-acre community on the Gulf of Mexico off Scenic Highway 30A. The look has proven popular with home buyers: Over the past several years, demand for homes there has increased, and prices have ballooned, according to local real-estate agent Jonathan Spears with Compass. In the first quarter of 2023, the average sale price in Alys Beach was $5.74 million, up about 25% from $4.59 million during the same period of last year, he said. Learn more here.

Office

A bleak office outlook may signal bigger problems

Rapidly rising interest rates have intensified concerns that the New York City office market, the largest in the country and a pillar of the city’s economy, could be at grave risk. That one-two punch could be worse than anything corporate landlords have experienced before, experts on the sector say, leading major banks and real estate analysts in recent weeks to warn that languishing properties along with falling property values and higher borrowing costs could increase the odds of a recession nationally and a budget crisis for the city.

More than two-thirds of all commercial real estate loans are held by small- and medium-sized banks, prompting concern that regional banks might be unable to withstand a wave of defaults if landlords cannot pay off loans. Some analysts have forecast a dim future for city centers, likening the crisis to the slow death of many American shopping malls. Learn more here.

Myths about converting offices into housing

Today, many U.S. downtowns are facing a crisis due to COVID-19. With the pandemic-induced shift to remote work and the slow return of office workers, the demand for downtown real estate—particularly office space—has plummeted. Office utilization averages less than 50% across major U.S. downtowns. Vacancy rates are 27% in San Francisco and over 16% in New York, and increasing. The downtown business ecosystem is also threatened as many small businesses (such as restaurants) struggle or close due to a lack of customers. Some urban transit systems have lost half their ridership and face a fiscal crisis.

Many argue that converting vacant office space into housing is a key strategy for addressing these challenges and revitalizing downtowns. Proponents of office-to-residential conversion note that since remote work is here to stay, office demand will never fully return to pre-pandemic levels, and the vacant office space can be repurposed into what cities currently need: housing. Moreover, they argue that the expense and complexity of conversions require public sector intervention and subsidy. Learn more here.

Residential

Top homebuilders in the USA by volume

The annual Builder 100 and Next 100 lists look at the top 200 home builders across the United States, ranked by closings. The lists, populated from responses to an annual survey, also include the firms’ gross revenue from home building operations and where and what they built. Learn more here.

Homes in the USA have become more expensive

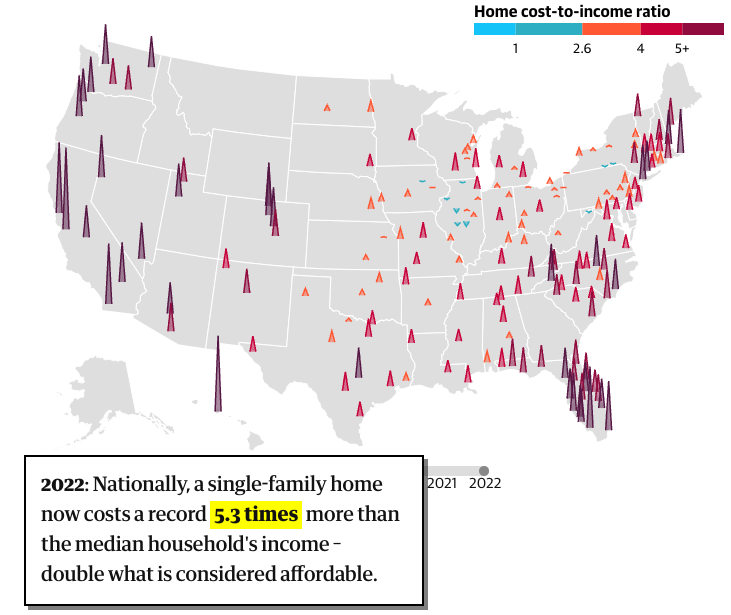

As of 2022, median home prices and rents in America hit all-time highs. This is great for those who already own as their property values continue to soar. But for many Americans, little is left over for the rising cost of everything else, like food and healthcare – let alone to save for a house. Ultimately, the dream of home ownership or an affordable rental is becoming unreachable for more and more Americans.

The change since 1990 in the graphics shown below.

One case of declining prices

As the Graystone condominium tower on Seattle's First Hill nears completion, fewer than 10% of the 271 homes have been sold, prompting developer Daniels Real Estate to cut prices and offer buyer incentives. The Seattle-based company said in a press release that it's "taking the lead in the condominium comeback" with the price reduction.

With the price cuts, prices are a third below the replacement value, according to the development team. The homes, including parking, are delivered at around $1,030 per square foot. To pencil again, a similar new build would require at least $500 per square foot more, or about $1,530. Learn more here.

Regional and metropolitan trends

Fast-growing counties in the USA

The U.S. Census Bureau's updated population estimates recently found counties with populations of at least 250,000 in 2020 grew by an average of 0.84% between 2020 and 2022. That's compared to a 0.44% average growth rate among all counties.

Among counties with at least 250,000 residents, the top counties for percentage growth were all suburbs of cities — St. Johns County, Florida (near Jacksonville); Hays County, Texas (outside of Austin); Williamson County, Texas (also outside of Austin); and Montgomery County, Texas (in the Houston metro area). Learn more here.

Coastal cities are less attractive to college grads

Major coastal metros have been hubs of the kind of educated workers coveted most by high-powered employers and economic development officials. Economists have lamented the growing coastal concentration of their wealth. A politics of resentment in America has fed on it, too. These urban centers have become a class of their own — “superstar cities” — with an outsize impact on the American economy fueled by the clustering of workers with degrees. But it appears in domestic migration data that higher-paid workers are also turning away from them years after lower-wage residents have been priced out of expensive coastal metros. Learn more here.

Around the world

Nanchang is a sign of China's housing crisis

China’s prolonged real estate slump has exposed cracks in cities like Nanchang, where years of nonstop building have created too much supply. By one measure, nearly 20 percent of homes in Nanchang sit vacant — the highest rate among 28 large and midsize Chinese cities. Learn more here.