ARES Urbanexus Update #152

This selection of real estate and community development news and information began publication in 2018. It is now distributed by the American Real Estate Society (ARES). Its founder, H. Pike Oliver, continues as curator, and the update is distributed free of charge.

Investment

Real estate and the US economy

According to the annual Economic Impacts of Commercial Real Estate research study conducted by the NAIOP Research Foundation, the impact of new commercial real estate development in the US continues to grow. Altogether, commercial, residential, institutional, and infrastructure development and operations of existing commercial buildings contributed $6.5 trillion to the US economy and supported 37.7 million jobs in 2022. Learn more here.

The housing market and the U.S. economy

A report issued by the Congressional Research Service ( Introduction to U.S. Economy: Housing Market) in January 2023 outlines how the housing market is incorporated into gross domestic product (GDP) in two ways. First, GDP includes all spending on the construction of new single- and multi-family structures, residential remodeling, and brokers’ fees, which is referred to as residential fixed investment. As of 2021, spending on residential fixed investment was about $1.1 trillion, accounting for about 4.8% of GDP. Second, GDP includes all spending on housing services, which includes renters’ rents and utilities and homeowners’ imputed rent and utility payments. As of 2021, spending on housing services was about $2.8 trillion, accounting for 11.9% of GDP. Taken together, spending within the housing market accounted for 16.7% of GDP in 2021.

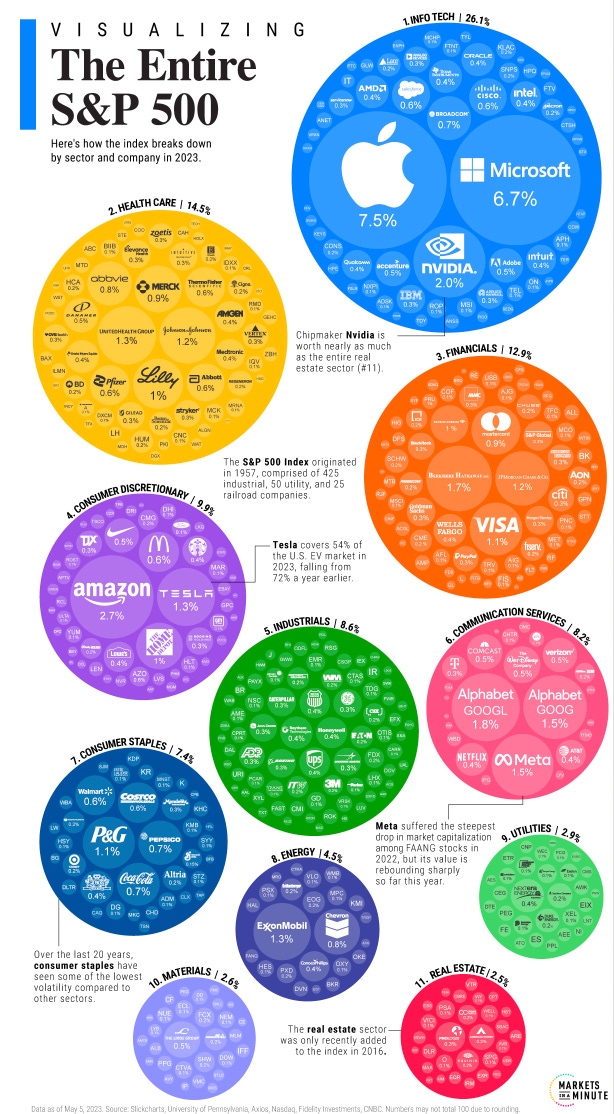

Real estate is only 2.5% of the S&P 500

While a NAIOP Research Foundation Study (Economic Impacts of Commercial Real Estate) found that residential and commercial real estate represents as much as 25% of the U.S. GDP, it comprises a small portion of the S&P 500. Those firms hold $7.1 trillion in assets, accounting for nearly 80% of available market capitalization on U.S. stock exchanges. The graphic below shows the makeup of the S&P 500. Learn more here.

Retail

Why do urban retail storefronts remain vacant?

Storefronts often remain empty for months or years at a time, even in some of the world’s highest-rent retail districts. Between 2015 and 2019, for example, empty storefronts in Manhattan remained vacant for 16 months, and less than half of the vacant units were filled after one year. Moreover, because neighborhoods with various restaurants, cafés, shops, and other services are desirable places to live and work, the lack of retail activity can negatively affect the broader community and the value of housing in those communities. As a result, policymakers in New York State (and several other states and municipalities around the US) have, at times, proposed levying a vacancy tax on empty storefronts as a way to encourage more retail activity.

In a working paper, “Option Value and Storefront Vacancy in New York City,” Daniel Stackman and Erica Moszkowski analyze why storefronts remain vacant for long periods of time and assess the consequences of a possible vacancy tax. We conclude that in the long run, a primary driver of retail vacancy in dense urban areas is the fact that landlords are willing to forgo rent today to preserve the option to lease their space to someone else (who might pay higher rents) tomorrow. We also find that while a vacancy tax similar to the one proposed in New York State would decrease the vacancy rate and rents, it would also lower tenant quality and lead to faster churn in the city’s storefronts. Learn more here.

Why are stores closing in big cities?

Big chains and others have closed stores in major US cities recently, raising the alarm about the future of retail in some of the country’s most prominent downtowns and business districts. Several forces are pushing chains out of some city centers: a glut of stores, people working from home, online shopping, exorbitant rents, crime and public safety concerns, and difficulty hiring workers. Learn more here.

Office

NYC tax revenue faces a modest decline due to hybrid work

If the value of office properties declines 40% from 2023 to 2029, there would be a revenue shortfall of $322.7 million in the fiscal year 2025 beginning July 1, 2024, per a report prepared by the city’s comptroller. The shortfall would increase to $1.1 billion in fiscal 2027, which makes up only 3% of the total property tax levy or 1.4% of city tax revenues. Learn more here.

Data on work-from-home

Go here to download a fascinating slide deck offering data on the current state of work-from-home (WFH) and managing hybrid-WFH and impacts on the economy provided by Stanford University economist Nick Bloom.

Residential conversion of downtown L.A. office tower

Much has been written in recent months about the ongoing struggles of the downtown Los Angeles office market and the possibility of converting millions of square feet of unused space into housing. Just west of the Harbor Freeway stands a 33-story, approximately 600,000-square-foot office tower completed during the late 1980s office boom. While the building was once named ARCO Tower for the oil and gas company that once called it home, the property has gone by 1055 7th Street since the departure of its namesake tenant more than two decades ago. It most recently housed Los Angeles County's L.A. Care health plan offices, which will be relocating into a 370,000-square-foot space at a neighboring building in 2024.

Landlord Jamison Services, Inc. has submitted an application to the L.A. Department of City Planning seeking approvals to convert the upper floors of 1055 7th Street into housing. Plans call for a total of 691 studio, one-, two-, and three-bedroom apartments, ranging from 538 to 1,304 square feet in size, as well as nearly 48,000 square feet of amenities such as theaters, fitness rooms, lounges, and business centers. The proposed project, as an adaptive reuse development, is not required to incorporate affordable housing. Likewise, no additional parking is required for 1055 7th Street, which is already served by the adjacent garage with a capacity for more than 1,100 vehicles. Learn more here.

Residential

Homebuilding starts to pick up

After months of a slowdown in the wake of weaker buyer demand, homebuilders are starting to pick back up on construction — and feeling more confident about the housing market since mortgage rates surged in 2022. Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1.63 million, a 21.7% increase from the April estimate of 1.34 million, the U.S. Census Bureau reported this week. Meanwhile, privately owned housing units authorized by building permits last month were at a seasonally adjusted annual rate of 1.49 million, 5.2% higher than in April but 12.7% less than the May 2022 rate. Learn more here.

Regional and metropolitan trends

Almost 20% of Californians say they are considering leaving

The findings of a poll from a consortium of local nonprofits aiming to take stock of the state’s mood point to a contradiction playing out across the Golden State: People are pleased by the bounty the country’s largest state had to offer and mostly favor its liberal attitudes on social issues, but are also far more concerned about their livelihoods than in recent years

Sustainability

Eco-conscious apartment building in Seattle restarting

Construction at 303 Battery, an eco-conscious apartment project in Seattle’s Belltown district under development by Seattle-based Sustainable Living Innovations, is restarting following a receivership agreement. The 15-story, 112-unit tower topped out last summer, but work stalled as the developer racked up dozens of liens.

When it broke ground in 2021, the project was been billed as the world’s first multifamily building to meet the net-zero energy requirements set by the International Living Future’s Building Challenge program. It is designed to use one-third of the water of a traditional building, with 80% of the hot water from showers taken by residents to be used for other needs. The air conditioning system will use 4% of the energy a traditional system uses. Learn more here.

Around the world

Real estate is a problem in China

According to The Economist, there are several reasons to be gloomy about China’s economic prospects, from America’s export controls on advanced semiconductors and skittish foreign investors to President Xi Jinping’s crackdown on big tech firms. But the main culprit for the recent weakness is property, a crucial source of China’s economic growth before the pandemic. Initially, activity slowed as the government sought to rein in heavily indebted developers and then more recently as sales weakened. Between January and May of 2023, for instance, real-estate investment fell by 7.2%, compared with the same period a year ago. The danger is that the property bust now becomes an enduring malaise. Learn more here.

How to escape China’s real estate crisis

As a prolonged downturn in China’s property market takes hold, Chengdu is an exception. By several metrics, including house prices and sales of new homes, it is faring better than almost anywhere in the country. At a national level, the central government’s response to the deepening property crisis, including an interest-rate cut announced on June 13th, has underwhelmed. China’s benchmark stock index has fallen by 8% since peaking this year in early May, when the country still appeared to be rocketing towards a full post-covid recovery. Now investors fear more developers will start to fall short of cash, defaulting on dollar debts in the process. Experts are asking how much local measures can pump up growth. Chengdu is a good place to search for answers. Learn more here.

Passings

Seattle skyline shaper Jon Runstad dead at 81

The company announced that Wright Runstad & Co. founder and Chairman H. Jon Runstad died on June 20, 2023. Runstad, who was 81, founded the company in 1972 and was CEO for nearly 47 years. Under his leadership, the company developed nearly 20 million square feet of office and mixed-use projects, including the iconic Rainier Square and 1201 Third Avenue, both of which define Seattle’s skyline.

Runstad and his wife, Judith M. Runstad, have been active philanthropists focusing on civic causes, entrepreneurial real estate education, and local charities. In addition to the University of Washington’s Runstad Department of Real Estate, Jon Runstad had a nearly lifelong involvement with the board of rowing stewards at UW. More recently, he was a prominent supporter of Seattle's emerging Waterfront Park. Learn more here.