ARES Urbanexus Update #155

Publication of this monthly selection of real estate and community development news and information began in 2018. It is now distributed by the American Real Estate Society (ARES). Its founder, H. Pike Oliver, continues as curator.

The economy in the USA

With just three months before 2023’s books close, recession bloodhounds are still sniffing for the scent of the much-expected Fed-induced severe economic slowdown. We’ve heard much howling, but thankfully, recession predictions of negative growth in this year’s latter half have proved wrong—so far.

The outlook turned more optimistic when the Commerce Department’s first-quarter estimate of 1.3 percent real GDP growth was revised significantly in June to 2.0 percent. Then, in late July, the department’s first estimate for 2023’s second-quarter real GDP growth came in at a healthy 2.4 percent. This figure was then revised downward to 2.0 percent on August 30. Of course, a possibly protracted government shutdown and/or auto workers strike could darken the economic picture.

Driven by strong retail sales and increases in nonresidential investment and state government spending, the second quarter’s initial estimate also included good news on inflation. The Fed-preferred Personal Consumption Expenditures Index grew at just 2.6 percent in the second quarter compared to the previous quarter’s 4.1 percent.

Learn more from a Mercatus Center Policy Brief here.

Office

Where office properly loans are distressed

The rate of loans backing office properties that are considered distressed or delinquent is rising as landlords of outdated office towers struggle to refill vacant spaces, and cash flow on those buildings becomes a bigger challenge.

A recent analysis by New York-based credit-ratings agency Kroll Bond Rating Agency LLC, also known as KBRA, found the rate of delinquent or specially serviced commercial mortgage-backed securities 2.0 loan volume hit 6.8% in August, up from 4.5% in June 2022. CMBS 2.0 refers to conduit loans issued after the global financial crisis of the late 2000s when most current collateralized mortgage-backed securities (CMBS) deals were financed.

Learn more here

All that empty office space in New York City

What happens if the nearly 100 million square feet of New York City workplace real estate stays empty? Caught amid the return-to-office stall is Eric Gural, whose family has a commercial real estate empire in New York City, GFP Real Estate, which owns and manages more than 55 properties and 13 million square feet, or some 2 percent of the city’s office real estate. The office market has faltered many times in the past and already twice in the current century—after the September 11, 2001, attacks and in 2008 during the Great Recession. But this time feels different. According to an article authored by Columbia and New York University researchers, the value of New York’s office buildings could fall by nearly $50 billion in the coming years. Learn more here.

A Canary Wharf skyscraper in London

HSBC’s plan to leave its Canary Wharf tower for a smaller site shows the global challenges ahead in repurposing unwanted office space for a post-pandemic world. The building’s fortunes are changing — much for the worse — with the bank relocating in 2027 after more than two decades in the Norman Foster-designed tower. Its new home will be a space roughly half the size in the City of London. And other major office tenants are leaving London’s second-biggest financial hub. Learn more here.

Why it’s so hard to run offices into residences

Most major cities have about 20 percent of their office space vacant and only about 2 percent currently undergoing a conversion, according to real estate firm CBRE. Cities need a conversion boom to help cut vacancy rates in half, a level that would stabilize property markets and re-create a feeling of pre-pandemic vibrancy. Right now, the ' financial and architectural challenges of converting offices to residences are too often prohibitive.

It’s hard to do a conversion. Office buildings weren’t constructed to be lived in. They don’t have the plumbing and electrical guts that homes require. Ceilings must be high enough that these utility additions won’t drop below regulation height, typically at least seven feet. There’s also the issue of windows. If the building is very wide, apartments or rooms near the center won’t have any.

Buildings with inner courtyards or other shapes that allow all areas to have natural light are better suited for conversion. Some older offices are also good candidates. Built before central heating and cooling systems, they were constructed from the outset to maximize window access and airflow. Learn more here.

Retail

Retailers bet wrong on stores

On August 21, 2023, The Wall Street Journal reported that one bright spot remains in American commercial real estate, even as landlords and brokers try to figure out what can be done with the country’s surplus of office space: retail leases. Construction of new retail space bottomed out during the Great Recession and never returned to speed.

But this year, about 1,000 more brick-and-mortar retail stores have opened nationwide than have closed, even with the loss of national chains such as Bed Bath & Beyond. Demand for shop space has stayed buoyant despite inflation and high interest rates. Some direct-to-consumer brands that originally forswore brick-and-mortar retail, such as Warby Parker and the bed-linens brand Parachute, have accelerated new store openings in the years since the pandemic’s peak. As it turns out, many people still want to try new shoes or lie down on a new mattress in person. Learn more here.

Record low retail vacancies in Greater Phoenix

Phoenix’s commercial retail real estate market has had one of its most successful moments in recent history, with a record low vacancy rate reported in the second quarter. According to a report by Colliers in Arizona, the Greater Phoenix retail market vacancy level hit a historic low of 4.8% at the end of June. The low vacancy rate reflects a strong demand from tenants to have a presence in one of the nation’s fastest-growing cities.

The data for Q2 2023 marked the 12th consecutive quarter that Phoenix’s retail vacancy rate has decreased. Eight out of nine geographic submarkets in the city posted retail vacancy decreases year-over-year. Downtown Phoenix was the only submarket with a rise in vacancies.

Learn more here.

Hospitality

Revenue growth remains vibrant

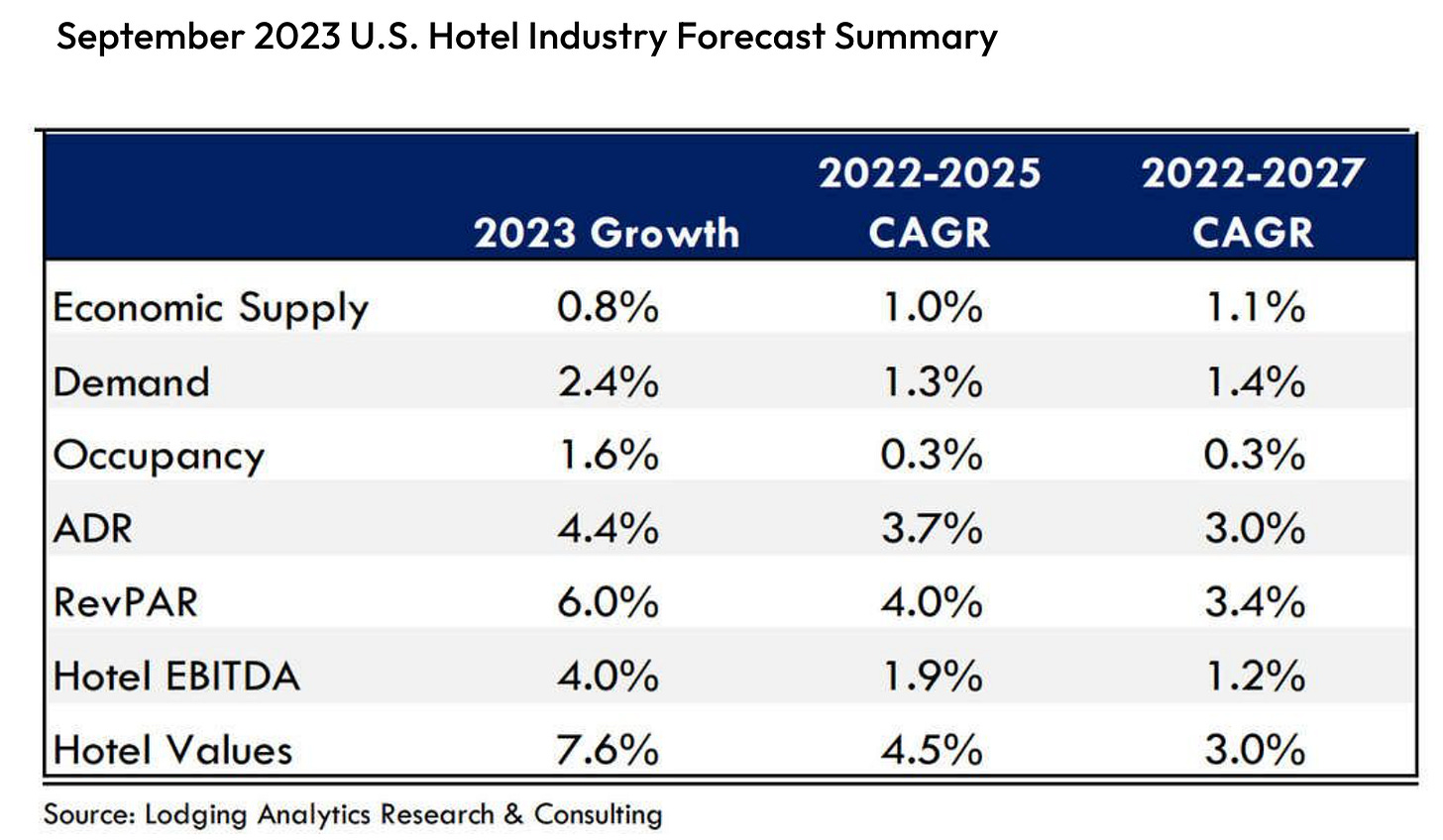

Notwithstanding the recent (but expected) deceleration in U.S. RevPAR growth, America’s lodging industry performance remains vibrant. Although Lodging Analytics Research & Consulting’s (LARC) forecast is modestly altered for 2023 and beyond, the overall outlook continues to be encouraging.

Despite the positivity, risks remain related to tightening lending standards across all industries, limiting economic growth. Moody’s Analytics forecasts GDP growth to slow from the 2.1% growth rate in 2Q-2023 to under 1% in 4Q-2023 and 1Q-2024 before growth accelerates again. Slowing economic growth will likely weigh on the rate of increase(s) across national lodging fundamentals. Learn more here.

Recovery varies by hospitality property type

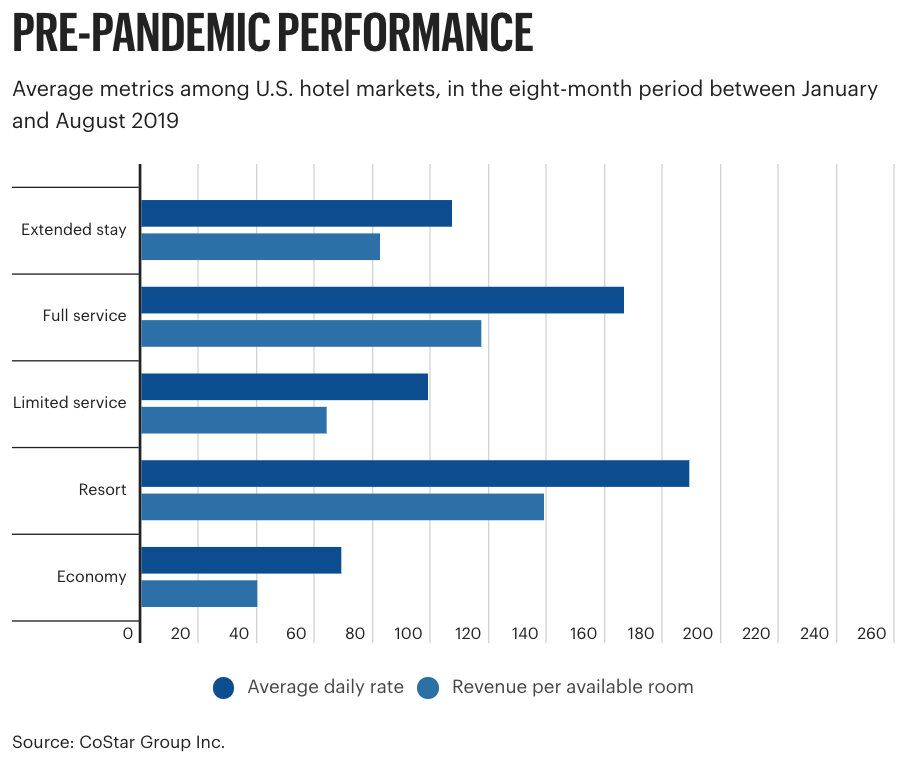

The national hotel market has emerged from its pandemic slump, as leisure and business travel have mounted comebacks in recent years. However, not all types of hotels benefit equally, and industry experts say those differences may persist in the post-pandemic world.

"Property types that overperformed are now getting more normal results, and the property types that underperformed are coming out and getting more normal," said Jan Freitag, national director of hospitality analytics at CoStar Group Inc.

Learn more here.

Master planned communities

Dorchester Bay City in Boston

The Boston Planning & Development Agency has approved the master plan of Dorchester Bay City, a mixed-use project on the city’s south side. The waterfront project is a redevelopment of the former site of the Bayside Expo Center. Accordia Partners leads the development team, a partnership between Boston developers Kirk Sykes and Dick Galvin and New York-based Ares Capital Corp.

Plans call for roughly 6.1 million square feet of office, life sciences, residential, and retail uses across 36.2 acres. The project will feature a 2.7-acre park at the water’s edge, a 6,300-square-foot pavilion with various amenities, and an 8,000-square-foot learning and innovation center. Approximately 20 percent of the residential inventory to be designated as affordable housing, specifically for households earning 70 percent or less of the area median income. Buildout could take 10 to 15 years to complete.

Learn more here.

Utah City

A barren vista looking over Utah Lake that once housed the mighty U.S. Steel Geneva Works has been cleaned and prepared to become the home of a major development. The Flagship Cos. and Woodbury Corp. announced “Utah City” as the name of the over 700-acre master-planned development focusing on sustainability and walkability. The site is located in Vineyard, UT, 39 miles south of Salt Lake City and eight miles northwest of Brigham Young University in Provo.

Jeff Speck and the town planning firm DPZ, founded by Andres Duany and Elizabeth Plater-Zyberk’ have designed Utah City. Over 17 million square feet of combined mixed-use space, including living, shopping, dining, entertainment and hospitality, is planned. The new community will also include 50 acres of planned open green space in the form of a 12-acre promenade that will run down the middle of the town center to he FrontRunner commuter rail service opened a station in the city in 2022, the shores of Utah Lake, as well as a network of parks and paseos. Learn more here.

Austin Point

The Signorelli Co. has announced plans for Phase I of Austin Point, a 4,700-acre master-planned community roughly 30 miles southwest of Houston in Rosenberg.

Upon completion, the development will feature an estimated 14,000 homes and 15 million square feet of multifamily, office, medical, retail, and hospitality space. The project will also include the extension of Fort Bend Parkway and Grand Parkway into the community.

Phase I of Austin Point is set to break ground in 2024 and will include constructing 400 homes. These residences will be built on smaller lots in an alley-loaded format, ranging from 1,300 to 4,500 square feet. Learn more here.

Metropolitan and regional trends

Re-emergence of the donut city?

After many decades of reinvestment and repopulation, some American downtowns now show signs of hollowing out again.

The widespread adoption of remote and hybrid work schedules has drained commercial offices and caused tenants to terminate leases. In several downtowns, office occupancy is at 50% pre-pandemic levels. Ripple effects include shrinking lunchtime crowds, slumping retail sales, and a drop-off in public transit ridership. For example, New York City’s subway ridership was 65% of pre-pandemic levels as of early 2023.

This is not a rerun of hollowing out experienced in many U.S. cities in the 1960s. The usual culprits of economic restructuring, racial tensions, shifting consumer preferences, and government inefficiency are all still involved, but these forces manifest in new ways. Learn more here.

Understanding downtown recovery

At the pandemic's start, 22 million people lost their jobs, domestic airline flights fell by almost three-quarters, and many office workers switched to working from home. These, among other factors, cause a huge drop in traffic, including visits to downtown areas. By early 2023, vehicular traffic was back, but there has been more variation in foot traffic levels across U.S. downtowns.

Recent research from the University of Toronto and UC Berkeley shows that Salt Lake City has recovered the highest percentage of unique visitors to its downtown relative to 2019. The chart below shows the city’s “recovery ranking” compared to New York, Chicago, Philadelphia, and Seattle—downtown areas that Brookings Metro has been charting as part of a research project on the future of downtowns.

Learn more here.

Construction

The stuff of cities

The city exists as a hub of culture, as a vessel for human problems, desires, and solutions, as an economic force, and as a metaphor. Then there’s the city as stuff. From Seoul to São Paulo, urban areas are fashioned from the same essential elements: brick, concrete, steel, glass, asphalt, and wood. The qualities and characteristics of these common building materials have profoundly shaped the societies that consume them—and the scale at which they’re being consumed has destroyed vital ecosystems and altered Earth’s climate.

Now, there’s a race to produce the physical building blocks of our society using methods that limit their environmental toll. In some ways, the new materials will resemble the old ones; in others, they’ll be fundamentally different. To build the cities of the future, we’ll need new stuff. —David Dudley, Bloomberg CityLab. Learn more here.

Make sure materials get used—again and again

What if we could harness the power and value of all we discard? Circular economy builder Garry Cooper presents a compelling vision for transforming cities into sustainable, circular economies, citing real-world examples of how repurposing materials from buildings to office furniture can significantly reduce greenhouse gas emissions, create jobs, and foster economic growth. A hopeful reminder of the profound impact individual actions can have on our shared future.

See Gary Cooper’s April 2023 TED presentation about this here.

Around the world

Trouble roils Evergrande and other Chinese firms

The real estate firm Evergrande halted critical work to settle its debts, and investors dumped their stock amid news executives were under suspicion by the authorities. Chinese government authorities have detained staff at the company’s wealth management arm. Two former top executives are reportedly being held, and its billionaire chairman is under police surveillance. T he company suspended trading in the stock of its three publicly traded companies in Hong Kong without a reason.

China’s housing market, once fueled by borrowing, has been hurting for several years since Beijing cracked down on the ability of real estate companies to take on more debt. In 2021, Evergrande was among the first and the most high-profile to default on a tower of unpaid bills. Dozens of other private developers followed, setting off fears about China’s broader economy, which has long depended on the housing market for its growth.

Learn more here.

Build, pause, demolish, repeat in China

China has adopted a unique "build, pause, demolish, repeat" strategy to rejuvenate its slowing economy. It focuses on tearing down tower blocks and temporarily halting construction on properties that could collectively accommodate 75 million people. This approach aims to curb excessive housing supply to prevent a drastic decline in property prices while stimulating economic growth through ongoing construction activity.

Researchers from UK-based Fathom Consulting estimate that approximately 3 billion square meters of housing, equivalent to housing for the entire UK population, has been put on hold or demolished in recent years. This strategy has been attributed to China's desire to balance short-term economic growth, social stability, and property market stability.

With the property sector accounting for a substantial portion of the Chinese GDP and facing challenges due to debt-laden developers and shifting market sentiment, Beijing's actions, including demolishing completed buildings, reflect a seemingly desperate attempt to find a delicate equilibrium between maintaining economic momentum and avoiding a property market crash. Alongside measures like reducing mortgage costs and offering special loans to developers,

See a video of building demolitions here.

Real estate distress in Germany

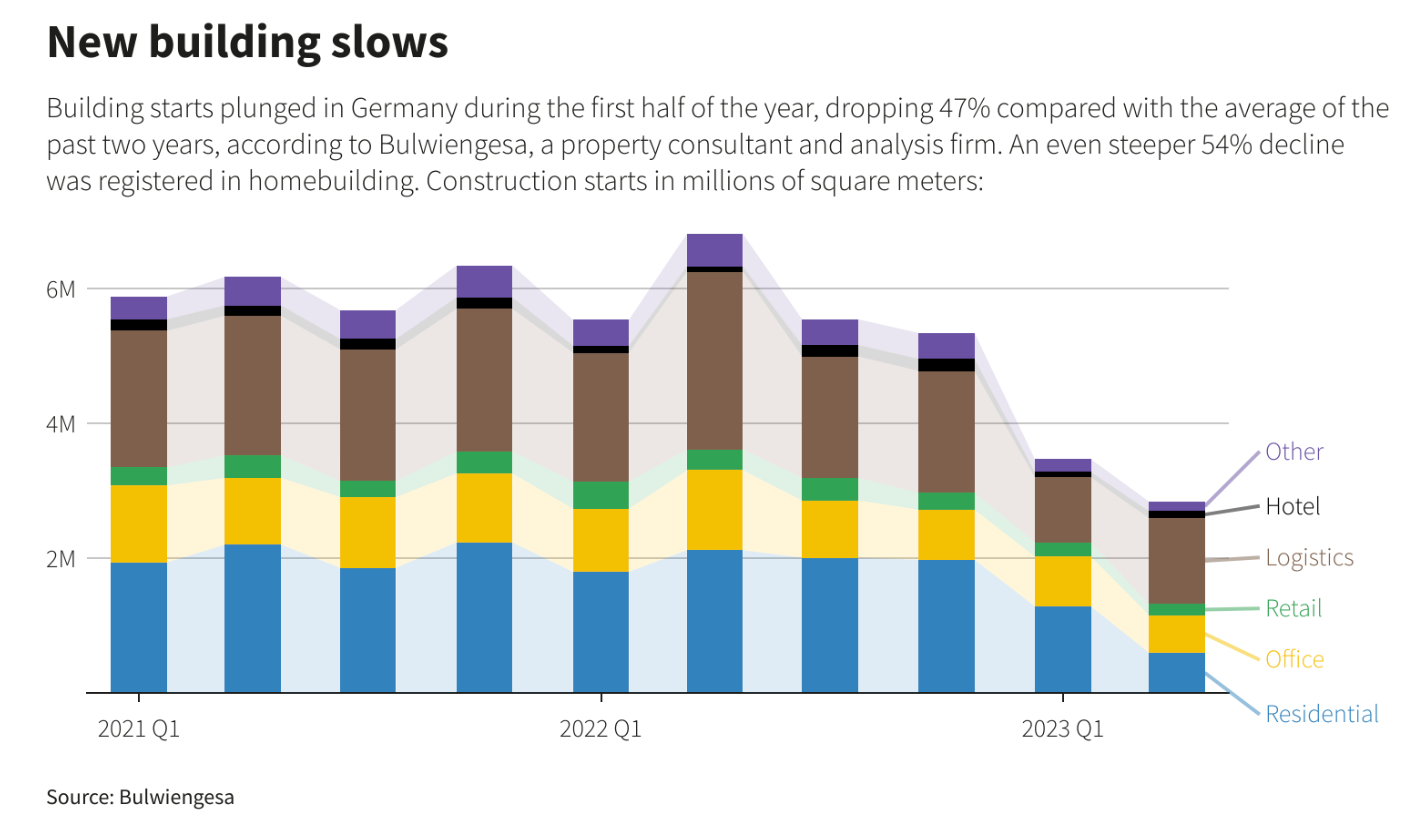

In the latest signs of stress in the sector, Germany's largest real estate group, Vonovia (VNAn.DE), posted multi-billion euro losses and writedowns, and job growth for construction workers has stagnated. New construction plummeted in Germany during the first half of the year, dropping 47% compared with the average of the past two years, and new building permits plunged 27% during the first five months.

The main factor has been the European Central Bank's sudden and rapid rise in interest rates as it clamps down on the highest inflation rates in decades, but there's more to it. Building costs have also soared, and the demand for offices and retail space has waned after the pandemic. The Ukraine war has also made German property seem riskier for foreign investors.

Learn more here.