ARES Urbanexus Update #157

Publication of this monthly selection of real estate and community development news and information began in 2018. It is now distributed by the American Real Estate Society (ARES), and its founder, H. Pike Oliver, continues to be its curator.

The economy in the USA

Inflation cools

In October, inflation in the U.S. cooled down more than expected as consumer prices held steady compared to the previous month. According to the Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers (CPI-U) increased 3.2 percent over the last 12 months, down from 3.7 percent the previous two months and below consensus estimates of 3.3 percent. On a monthly basis, prices were unchanged for the first time since July 2022, as a drop in gas prices offset a further increase in rents and other shelter costs. Meanwhile, core inflation, which excludes volatile food and energy prices, continued its downward trend, falling to 4.0 percent in October - the lowest rate since September 2021.

Due to its weight in the Consumer Price Index, the cost of shelter continues to be a major driver of inflation. Rents and owners' equivalent rents of residences increased 7.2 and 6.8 percent year-over-year in October, respectively, as the index for shelter climbed for the 42nd consecutive month. In fact, excluding the impact of shelter, inflation would have fallen to 1.5 percent last month, below the Fed's target level of 2 percent.

Learn more here.

Office

Support for residential conversion

As cities across the US struggle with climbing office vacancies and unaffordable rents, the White House has released a plan to help property owners convert empty offices into apartment units. By opening significant financing resources to office-to-residential conversions and providing technical assistance, the Biden administration aims to make it easier for these challenging rehab projects to advance — with an eye toward sustainability and affordability.

The Department of Transportation will make such projects near public transit eligible for below-market financing programs that account for billions of dollars in loans. Similarly, the Department of Housing and Urban Development will expand the use of federal housing dollars available to state and local governments to include these conversion projects. The White House is also releasing a commercial-to-residential guidebook detailing more than 20 federal programs across six agencies to support the efforts.

Learn more here.

We Work leases

Filing Chapter 11 allows WeWork to reject leases, among other options, as it works to restructure its business. WeWork is working with Hilco Real Estate LLC as its real estate advisor in the lease renegotiation process. According to the bankruptcy filing, it is in active negotiations with more than 400 landlords to amend its lease agreements.

The locations identified in the bankruptcy filing are largely concentrated in gateway cities, where WeWork has the biggest presence. But New York has the most impacted locations, with 40 offices named in the filing. Other affected cities include the Los Angeles and San Francisco metro areas, Boston, Atlanta, Phoenix, Chicago, Denver, Seattle, and St. Louis, as well as five offices in Canada.

Learn more here.

Residential

Micro housing

David Neiman is a principal at Seattle-based Neiman Taber Architects. He is deeply involved in micro-housing as an architect, developer, and public policy advocate. His firm creates plentiful, high-quality, small-unit housing to support livability and promote community among residents. According to Neiman, compact studio apartments, or micro-housing, can allow people with modest incomes to live in desirable and amenity-rich neighborhoods.

Unfortunately, the International Building Code's arbitrary rules prohibit the kind of small, efficient home designs that could provide comfortable living spaces at an affordable price. However, the National Healthy Housing Standard provides guidance on human health and safety founded on empirical data and public health literature. Following this guidance would make our housing smaller and more beneficial to residents. This could also unlock thousands of homes that better serve a resident’s day-to-day needs and comforts while providing more affordable and plentiful housing options in some of Cascadia’s most vibrant communities.

Learn more about Neiman Taber Architect’s work here, including examples of efficient floor plans.

Homeowner associations

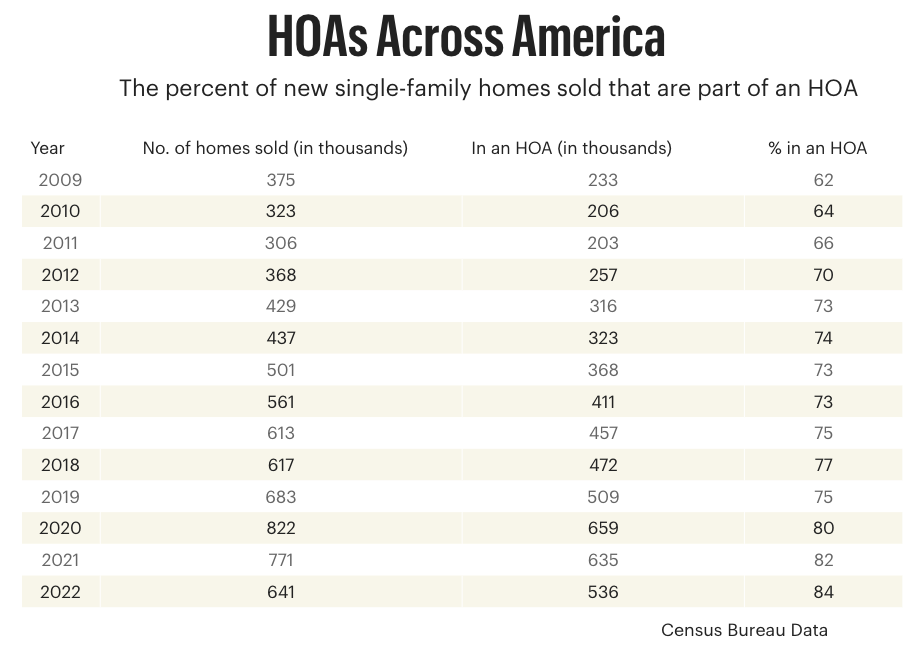

Homeowner’s associations (HOAs) originated to maintain private ownership over shared but private neighborhood amenities and spaces, such as pools and parks. In 1970, just 10,000 communities across the country were part of an HOA, or about 700,000 housing units, according to data from the Foundation for Community Association Research.

The number of Americans that live in an HOA has skyrocketed in the decades since, with more than 74 million Americans now covered by an HOA. In the United States, the number of newly built single-family homes sold in 2022 that were part of an HOA reached a high of 84% — up from 62% in 2009, according to data from the U.S. Census Bureau.

Learn more here.

Amazon HQ2 and the housing market

According to a report by Bright MLS, the impact of Amazon’s second headquarters on the housing market in Arlington County, Virginia, since the announcement in November 2018 has been hard to pinpoint. The report notes that while the announcement prompted both elation and anxiety, the effect on the housing market was short-lived, as the COVID-19 pandemic and the resulting government and business responses to the pandemic have had a much bigger impact.

The report also states that many factors were at play since Amazon said it would bring 25,000 employees to the county in a multiphase rollout. About 8,000 have been hired, and the first new construction opened this year. Looking at the period between the November 2018 announcement and the start of the pandemic in the first quarter of 2020, detached homes around Amazon’s HQ2 posted double-digit price appreciation, according to the report. That was higher than the rest of the Washington, D.C., region. Still, that appreciation has slowed from the genesis of the pandemic until today — both in the immediate area and the region overall.

The delay of the second phase of HQ2 will likely reduce the impact of housing bumps related to Amazon. Still, supply-demand challenges will continue to impact Greater Washington’s home prices, said study author Lisa Sturtevant, chief economist for Bright MLS.

Learn more here.

Retail

From department stores to apartments

In an example of productive adaptive reuse, a former Sears store in Rochester, New York, is now a 73-unit affordable housing project for seniors. Adele Peters describes the project in Fast Company, adding that underused malls present a convenient opportunity to build more housing. Peters states, “A nonprofit Enterprise Community Partners report estimates that nationwide, repurposing 10% of strip mall space could create more than 700,000 new apartments”—a small but not insignificant contribution to the estimated 3.8 million housing units needed.

As Peters explains, strip malls are easier to convert to housing than office buildings. “At the former Sears store outside of Rochester, developers were able to repurpose the building by adding windows to the facade and three interior courtyards so that there’s natural light in each apartment. Adding another apartment building in the parking lot meant the project had enough units to make economic sense.”

Similar projects are underway in California, where recent changes to state law made acquiring permits for commercial-to-housing conversion projects easier. One estimate calculated the potential for as many as 1.37 million homes in the San Francisco Bay Area alone.

Learn more here.

Shopping mall makeovers in Southern California

Orange County shopping malls are undergoing makeovers to the tune of nearly $8 billion. The owners of eight malls across the county are redeveloping vacant anchor stores and unused parking for new homes, dining, and entertainment. Over the past year, around 4 million square feet of mall retail space was bulldozed. Across the eight projects, 13,000 homes are expected to be built over the next decade. The mall projects aim to preserve 6 million square feet of retail stores, down from nearly 8 million square feet before construction.

Learn more here.

Transforming San Francisco’s Stonestown Galleria

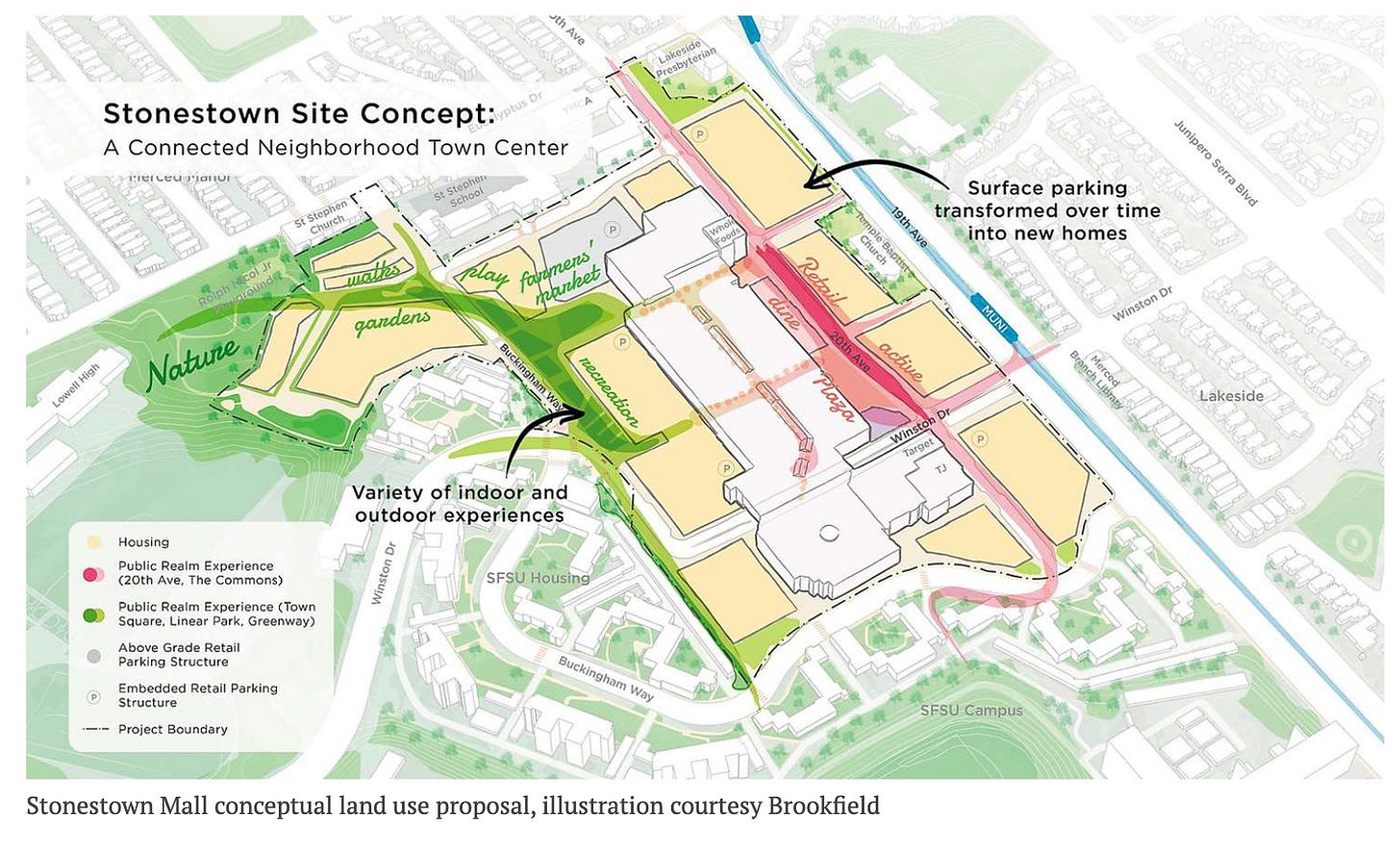

Stonestown Galleria, located about 6 miles southwest of the civic center in San Francisco (a 27-minute streetcar ride), is transforming from a retail center to a town center. The plan includes 2,900 new residential units around the mall in buildings ranging from three to 18 stores, 200,000 square feet of a new street-facing merchant corridor along 20th Avenue, and six acres of parks plazas and open space with areas for outdoor dining and a farmer’s market.

Learn more here.

Metropolitan and regional trends

Worrying about the wrong downtowns

“Urban doom loop.” “Office real estate apocalypse.” Anyone who reads business news has seen dire predictions for America’s downtown commercial towers, which emptied when the coronavirus arrived and remain under-occupied three and a half years later. Most coverage centers on the most expensive big cities, such as New York and San Francisco.

Some major real estate investors in New York are halting debt payments for certain properties and giving up control to their lenders. The shift in the market could cost New York City 3 to 6 percent of its tax revenue, by some estimates. But the city will still be the world’s financial capital, a tech hub, the headquarters of a slew of major corporations, and home to major educational, medical, and cultural institutions—all generating demand for office space even in the remote-work era. New York, in other words, will be fine.

By contrast, if office rents in the Rust Belt or the Mississippi River Valley drop by nearly half, downtowns in those regions face abandonment—not only by white-collar businesses and the shops and restaurants that once served their employees but also by the owners of entire buildings. In a city such as Dayton—which, according to Colliers, has downtown Class A rents of $18 a square foot per month and had a vacancy rate of more than 25 percent even before the pandemic—rents can’t fall far while still yielding enough money to pay taxes and operating costs.

Learn more here.

Americans head for the drive-through

Getting a meal through a car window began to define the nation’s food culture the moment the founders of In-N-Out Burger set up a two-way speaker in 1948. But the drive-through has never been as integral to how America eats as it is now. The pandemic sent people into the comforting isolation of their cars to get tested for COVID-19, celebrate birthdays, and even vote. And now, it seems, they don’t want to get out. At least to eat.

Drive-through traffic rose 30 percent from 2019 to 2022, according to a report from the food service research firm Technomic. Meanwhile, the number of people eating inside fast-food restaurants in the first half of 2023 fell by 47 percent from the same period in 2019. According to a September report by Revenue Management Solutions, Drive-throughs now account for two-thirds of all fast-food purchases.

Why the new wave of drive-through love? Because the experience has become faster and smoother, industry executives say. The pandemic turbocharged upgrades already underway, including better mobile ordering, streamlined kitchens, and smarter traffic management.

Learn more here.

Master-planned communities

Lendlease and Google terminate Bay Area venture

Lendlease Group (LLC.AX) and Alphabet's (GOOGL.O) Google are terminating development services deals for four master-planned San Francisco Bay Area districts. Lendlease bagged the contract from Google in 2019 to develop the residential and retail space in Sunnyvale, San Jose, and Mountain View, which was envisioned to bring around 15,000 new housing units to the region ultimately. The agreement called for Lendlease to develop up to 15 million square feet of residential, retail, and hospitality space, and Google was to develop office space.

The two companies announced the termination decision in a joint statement, citing "changing market conditions" and "different strategic priorities" as the main reasons for ending the partnership. The effort faced several challenges, including regulatory hurdles, community opposition, and the impact of the Covid-19 pandemic on the real estate market. Google and Lendlease said they remain committed to delivering high-quality projects in the Bay Area and will continue to work together on other opportunities worldwide.

Sustainable construction

New dreams for an old material

Building codes are being rewritten in Europe and the United States to accommodate big wooden structures. And trailblazing architects and engineers — and their early adopter clients — are in a proof-of-concept race to erect ever-taller timber towers. The architects designing tall timber structures say that, if desired, the Empire State Building could be replicated in wood. Until recently, there were strict limits on how tall a wooden building could be. Building codes are being rewritten in Europe and the United States to accommodate bigger wooden structures.

Learn more here.

Repurposing an abandoned government building

The renovation of the former Federal Reserve Bank in Seattle features a glass addition that appears to float over the historic building. The design for the landmarked project had to be sensitive to specific federal and state requirements, which don’t always align with each other.

When long-time Seattle-based developer Martin Selig bought the property at a government auction in 2014, he aimed to update it for contemporary use. He commissioned the Seattle studio of Perkins & Will to revitalize the iconic stone box with a modern addition and new amenities, a particularly difficult mission given the property’s landmark status.

Perkins & Will calculated how much carbon is embodied in the original building and repurposed original materials wherever possible to lower its carbon emissions footprint. A life-cycle analysis conducted at the end of construction found that preserving existing building materials saved approximately 50% of the building’s carbon emissions from construction compared with projects of similar size and complexity.

Learn more here.

Transportation

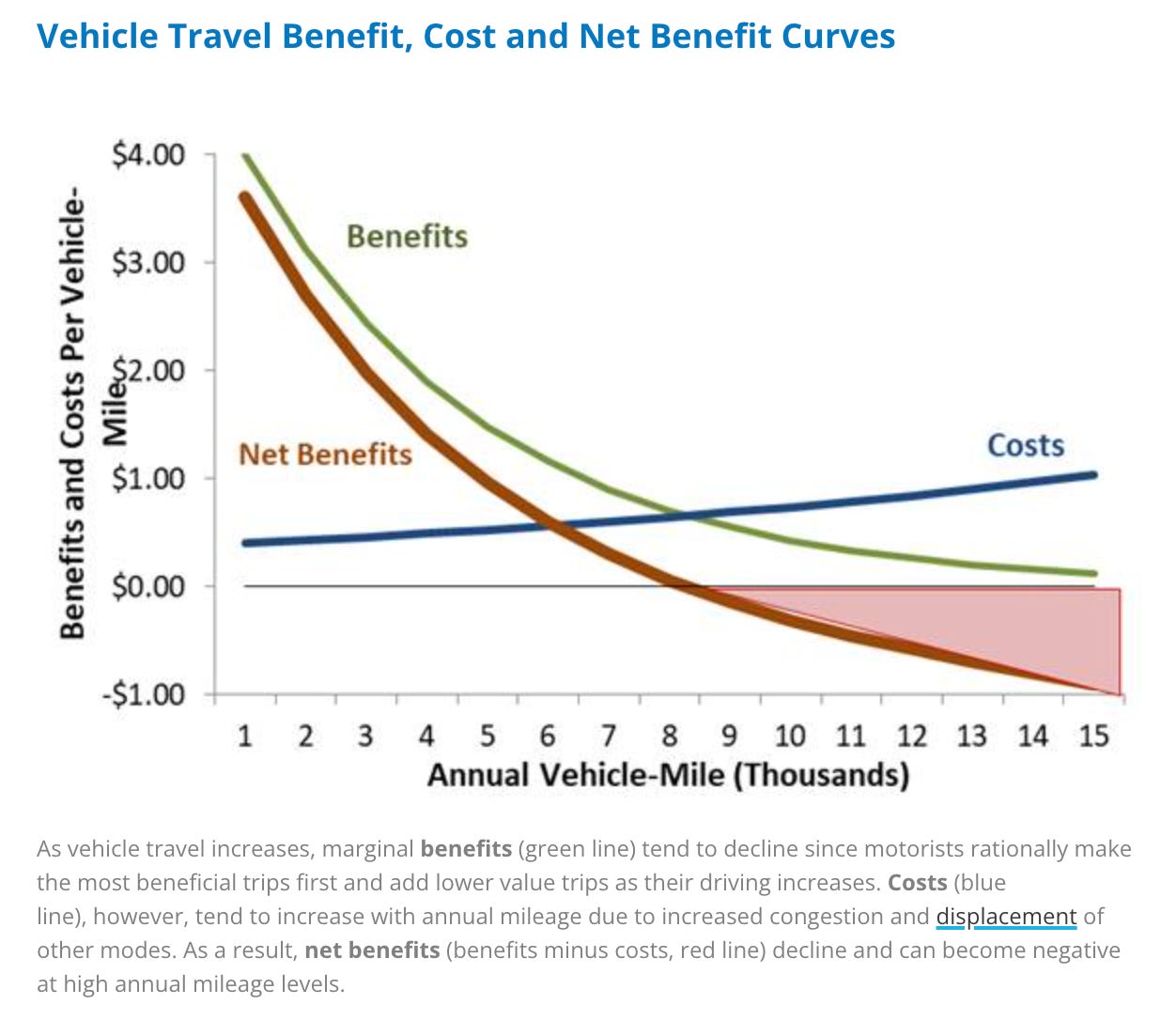

Less vehicle travel is more

Todd Litman of the Victoria Transport Policy Institute illustrates how motor vehicle travel provides many benefits but imposes high costs on users and communities. With better planning, people can drive less, rely more on non-auto modes, enjoy more access, and be better off overall. Learn more here.

Sustainability

Tracking progress toward net-zero emissions

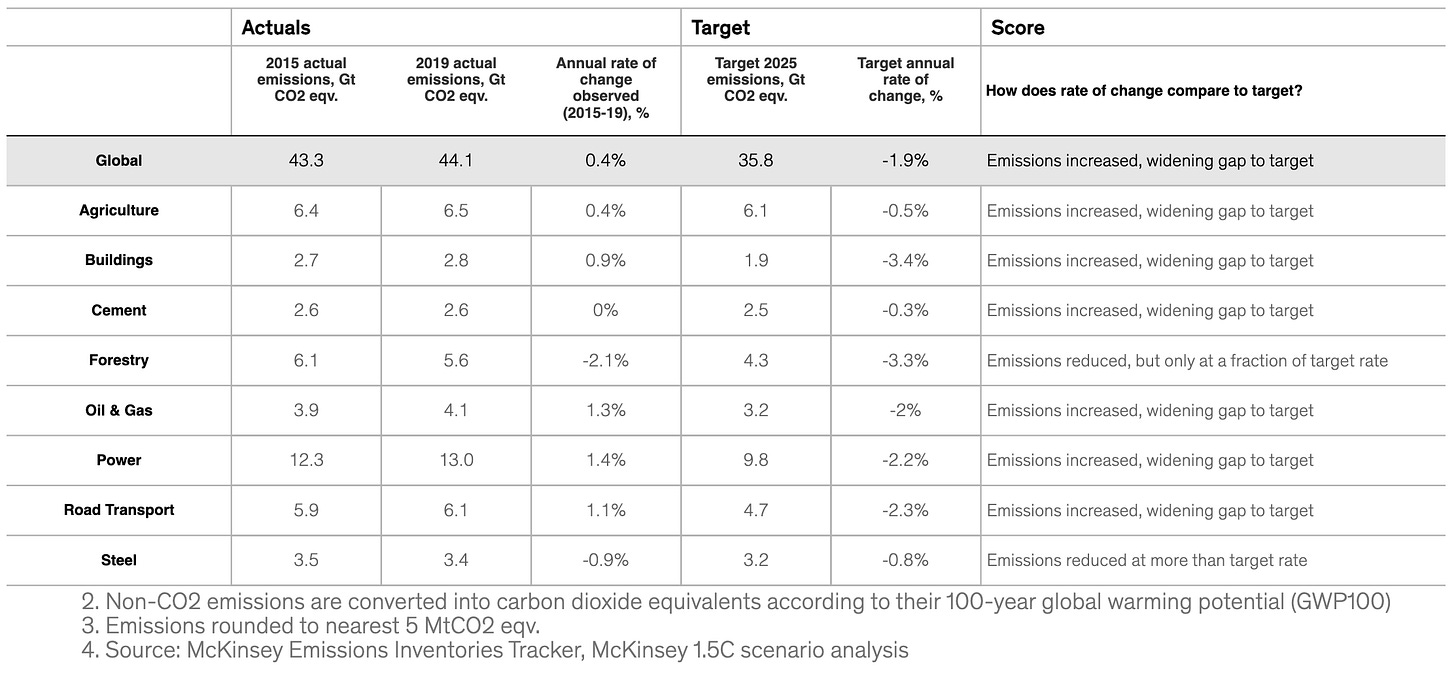

An interactive tracker from McKinsey & Company’s sustainability group aims to monitor progress toward achieving global net-zero emissions by 2050. It is designed to offer a more robust way of assessing progress to measure emissions and examine how the underlying requirements for a net-zero transition are met across categories, sectors, and geographies. It combines lagging and leading indicators to do this.

Learn more here.

Progress scorecard

Around the world

Real estate crisis in China

Sales, construction starts, and investments are plummeting. Few major developers will survive without massive bailouts. A large bubble—based on decades of chasing fast growth and price rises—is deflating. China’s residential real estate sector is huge, with estimates ranging up to 29% of GDP compared to 18% in the United States.

The most prominent Chinese real estate developers—Evergrande, Country Garden, and Sunad — are among scores of firms inching toward bankruptcy. Since about 70% of China’s household wealth is held in real estate, it will likely take years to rebuild consumer confidence and purchasing power.

Learn more here.

The articles chosen for this site are timely and provide information on "real time" issues for people who haven't the time and patience to pore over numerous sources to get a broad understanding of development trends and happenings.