ARES Urbanexus Update #158

The American Real Estate Society (ARES) distributes this monthly selection of real estate and community development news and information. H. Pike Oliver continues to curate it, as he has since 2018.

Outlook for North America in 2024

According to the Economist, the US presidential election will significantly impact the economy in the coming year. However, the real estate industry will also have to deal with the effects of increased borrowing costs. Fortunately, concerns about inflation are decreasing, and the Federal Reserve may provide some relief by lowering interest rates at some point during the year.

Construction

Why is it so expensive to build in the USA?

Construction represents about 4 percent of GDP in the United States. That’s a lot for one industry, certainly enough for an economist like Chad Syverson to be concerned if productivity is not growing. Professor Syverson and his colleague Austan Goolsbee, who recently became president of the Chicago Fed, have published a working paper called The Strange and Awful Path of Productivity in the U.S. Construction Sector.

Goolsbee and Syverson conclude that productivity in the construction sector has fallen significantly over the past half-century. The value added by a construction worker today is about 40 percent less than in 1970. This is exactly the opposite of how productivity has changed in most other industries, like agriculture, manufacturing, and information technology. And when productivity falls, prices often rise.

Freakonomics has published an informative podcast exploring factors affecting the USA's construction productivity. You can read the text or listen to a 59-minute podcast here if you'd like.

Office

Most office loans struggle to refinance

Moody's Analytics Inc. found an estimated $182 billion is expected to mature among major commercial real estate property types in 2024. Among those, an expected $47 billion is forecasted to mature in the office loan world, according to Moody's, which analyzed data from the Mortgage Bankers Association and the Federal Insurance Deposit Corp., as well as its own data.

Moody's also looked at the share of commercial mortgage-backed securities loans paid off at maturity in 2023 by sector. Most office loans (68.6%) were not paid off at maturity. Moody’s predicts that the share of office CMBS loans struggling to refinance in 2024 will rise to 76%.

You can learn more here.

Office building bidding won by current owner

Another major Downtown San Francisco office building has sold at a considerable discount — but in the case of 115 Sansome, the price was bid up 40 percent by a diverse array of buyers, indicating the city may be past the bottom of the commercial market.

The winning bid came from the building’s current owner, Vanbarton Group. With the short sale, Vanbarton has canceled its debt on the building it bought for $83 million in 2016. Instead, the all-cash deal this week closed at around $35 million. Public records show that the 2016 loan from Bank of America amounted to about $53.6 million, and city documents recorded on Dec. 11 confirm that the loan went into reconveyance.

You'll be able to learn more here.

Residential conversion potential

Since the COVID-19 pandemic, office space has been plentiful, and residential real estate supply has been inadequate in many global cities. Yet, even if all vacant office buildings were converted to residential space in many of these urban areas, according to McKinsey Global Institute partner Jan Mischke, senior partner Aditya Sanghvi, and colleagues, available housing would increase by only 3 percent. You'll be able to learn more here.

Cleveland leads the US in empty office conversion

Since 2016, developers have converted five office towers around the square into residences. New restaurants and coffee bars have also opened. The key to Cleveland’s success? The transformation efforts are focused on a compact area around a park called Public Square. Apartments immediately around the square increased from around 40 in 2016 to more than 1,200 by the end of 2023.

A year-long project studying how to revive downtowns has identified three keys to success: First, to focus on a few blocks at a time (what urban planners call a “node”). Second, to make it as easy as possible to convert old office towers for new uses via tax incentives and expedited permitting. Third, to offer unique amenities for residents, workers, and tourists. Cleveland did all three in the area around Public Square.

You'll be able to learn more here.

Master-planned communities

The Woodlands in the greater Houston area

The Woodlands, one of the most successful master-planned communities in the USA, has launched a yearlong celebration of festivities leading up to the 50th anniversary of its official opening in October 2024. Founded by energy entrepreneur and philanthropist George P. Mitchell, the 28,500-acre, 44.5-square-mile community is a wooded oasis 27 miles north of downtown Houston. As of 2023, The Woodlands has more than 120,000 residents, 2,400 employers, and nearly 67,000 employees.

Here is a brief chronology of the ownership of The Woodlands:

1964 - George Mitchell buys the Grogan Cochran Lumber Co.’s land, including 2,800 acres that would become the first piece of The Woodlands’ property.

1964 - 1974 - An additional 17,455 acres were obtained via 300 transactions. A grand opening of The Woodlands was held in October 1974, and approximately 8,250 acres were added to the master-planned community in subsequent years.

1997 - Morgan Stanley partnered with Crescent Real Estate Equities and purchased the Woodlands Corp. and its assets at The Woodlands.

2003 - The Rouse Company purchased Crescent Real Estate Equities co-ownership interest in The Woodlands.

2004 - General Growth Properties acquired The Rouse Company and transferred its assets into The Howard Hughes Corporation, which it had acquired in 1996.

2010 - General Growth Properties spun off The Howard Hughes Corporation as part of a corporate restructuring.

2011 - Howard Hughes Corporation acquired Morgan Stanley Real Estate’s 57.5% interest in The Woodlands Development Company and became sole owner and operator.

You can learn more here, here, and here.

Storyliving by Disney and DMB

Disney announces plans for Asteria, a new residential community near Raleigh, Durham, and Chapel Hill, North Carolina. Inspired by the spirit of discovery, the Asteria community is designed to encourage exploration of the region's natural beauty and spark life-long learning. The Asteria community is in the beginning stages of planning with Walt Disney Imagineering and DMB Development.

The Asteria community is the second Storyliving by Disney community in the U.S., following the Cotino community, which is currently under development in Rancho Mirage, California. Pre-sales appointments for homebuying in the Cotino community are now underway. Additional Storyliving by Disney locations are under exploration.

You can learn more here.

Residential

Not-in-my-backyard zoning battles

Development and zoning reform supporters have won several high-profile victories this year, providing the latest twists in an ongoing housing fight stretching to every corner of the United States.

Lawmakers in Montana passed a sweeping series of bills to legalize duplexes in all single-family-zoned neighborhoods. The legislation also allows homeowners to build “accessory dwelling units” on any detached house, limits parking mandates to one space per home, and shifts development review to earlier.

In Vermont, Gov. Phil Scott signed into law the right to build duplexes anywhere year-round residential development is permitted, with triplexes and four-unit buildings in some areas and city zoning reforms.

California Gov. Gavin Newsom signed into law 56 bills aimed at homeownership affordability by streamlining development, funding new affordable housing units, and setting maximums on security deposits.

Taken together, the bills mark a pivotal moment in the ongoing battle between the “not-in-my-backyard” — or NIMBY — opposition to various housing developments and the more nascent “yes in my backyard” YIMBY counter-movement, as momentum builds to allow more housing as a means to increasing housing affordability or at least slow the rise in housing costs.

The conflict cuts across the traditional left-right paradigm that often defines modern politics. You'll be able to learn more here.

Homebuyer helper startup Flyhomes lays off staff

Seattle-based real estate startup Flyhomes helps home buyers secure purchases with all-cash offers. It laid off staff in July and November 2022 and implemented another round of layoffs in November 2023. The firm cited “persistent and worsening industry headwinds.”

Real estate startups have been hit hard by higher mortgage interest rates and broader macroeconomic headwinds, and layoffs have been felt across the industry at companies including Redfin, Opendoor, Compass, and others.

Founded in 2016, Flyhomes is led by CEO and co-founder Tushar Garg. It has raised over $200 million, including a $150 million Series C round in June 2021. Learn more here.

Housing in 2024

After a year marked by volatile — and frequently high — mortgage rates, little inventory, and affordability issues that sidelined many buyers, the 2024 housing market outlook offers more of the same, albeit with some relief.

Housing economists vary somewhat in their assessments of what's to come in the for-sale market during the next 12 months, and predicting factors like where mortgage rates will end up can be difficult. Most, however, agree the conditions for housing will improve, even if only slightly, and that's expected to unlock inventory, moderate home-price appreciation, and make transactions easier to achieve.

You'll be able to learn more here.

Climate change

Fossil fuels and COP28

After a few newsworthy bumps in the road, the COP28 climate conference came to a somewhat happy ending — depending on who you ask — as almost 200 countries made a landmark pledge to "transition away" from fossil fuels for the first time in history. Representatives agreed to the deal in the final hours of the annual UN summit and were met with a standing ovation. However, activists took issue with how the language around fossil fuels, which account for almost 90% of the world’s CO₂emissions, had been reduced in the new agreement.

Urban development at COP 28

Urban development was a pertinent topic at the 2023 United Nations Climate Change Conference (COP28). The fact that buildings account for 40 percent of global carbon emissions at the United Arab Emirates-hosted conference provided insight into balancing immediate profitability and enduring environmental stewardship. You'll be able to learn more here.

Why decarbonize the built environment?

The built environment ecosystem comprises real estate and infrastructure and touches all aspects of human life, from homes and offices to factories and highways. It is responsible for about a quarter of the world’s greenhouse gas (GHG) emissions. Because the built environment encompasses the whole planet, the movement toward its decarbonization needs to be global in scope. The built environment accounts for 14.4 metric gigatons of carbon dioxide equivalent (GtCO2e) of emissions worldwide annually. Approximately 26 percent of all GHG emissions and 37 percent of combustion-related emissions come from the construction and operation of the built environment. You may learn about reducing GHG emissions from the built environment here.

U.S. building emissions continue to increase

U.S. building emissions increased 3% from 2010 to 2020. Without significant interventions, this trend looks set to continue through 2050, according to a new body of research conducted by sustainability consulting firm 3Keel and building manufacturer Kingspan. Increased emissions in the U.S. contrast with reductions seen in other G20 nations, the firm’s November 2023 Global Retrofit Index Interim Report found. Over the next 20 years, the U.S. must cut building emissions by an additional 73% to align with national net-zero emissions goals. Learn more here.

Regional and metropolitan trends

The world’s most liveable cities

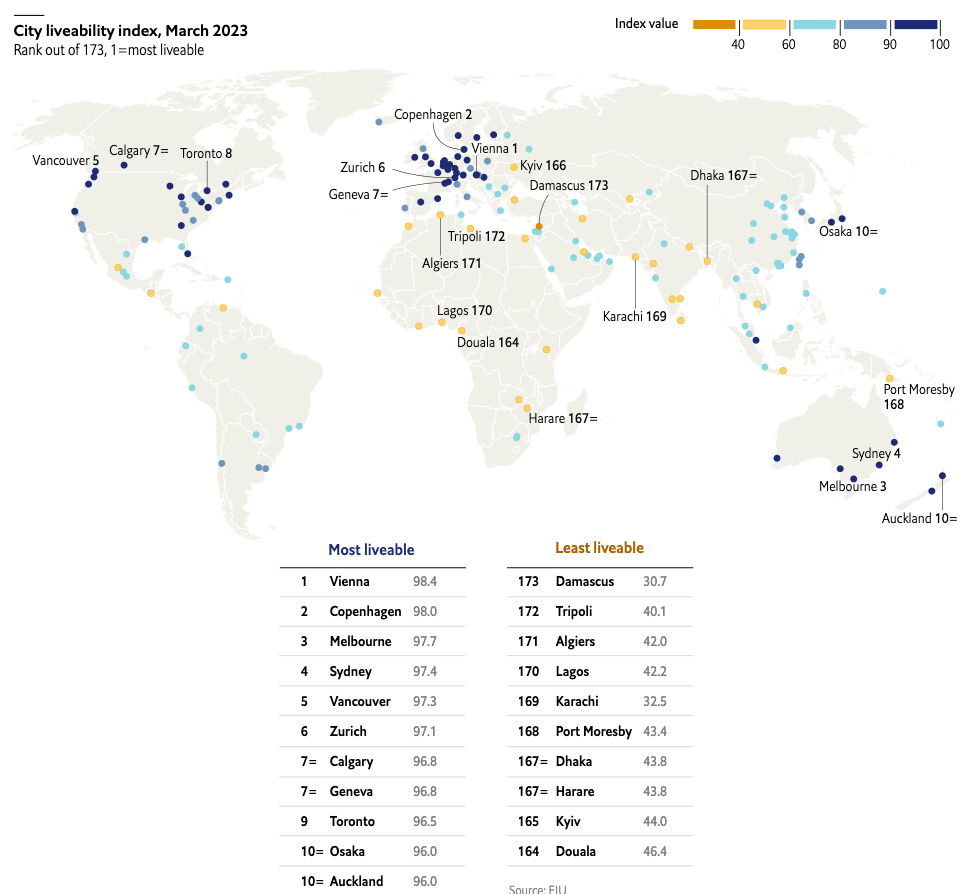

Living conditions in cities worldwide have fully recovered from the deterioration caused by the COVID-19 pandemic, as the Economist Intelligence Unit’s latest liveability index shows. It rates living conditions in 173 cities across five categories: stability, health care, culture and environment, education and infrastructure. Cities in the Asia-Pacific region have rebounded the most. The index also suggests that life in cities is a bit better than at any time in the past 15 years. The charts below show which cities topped the ranking.

Can nothing stop London?

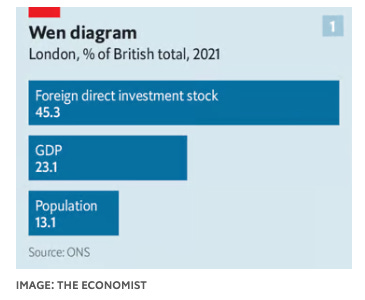

Cue a perfect storm of woes that threatened to capsize cities in general and London in particular. Already, its mercantile heart had been shocked by the financial crisis. Then, a cosmopolis that runs on immigration faced the shuttering of Brexit, and the pandemic barred tourists from one of the planet’s most visited places.

Yet, London is thriving—a hardiness that holds lessons for cities everywhere. Its globalized economy has weathered Britain’s exit from the European Union far better than doomsayers had predicted. For all the political bluster on immigration, it remains a magnet for ambitious newcomers. And it is better placed than many cities to absorb the disruptions of COVID-19. Traverse London from south to north and west to east, and you find that its biggest challenges result from its dynamism rather than decline.

You'll be able to learn more here.

Tech jobs are finally spreading out in the USA

For years, tech optimists and regional leaders have hoped for what AOL co-founder Steve Case calls the “rise of the rest”—the growth of substantial tech ecosystems far from the Bay Area and into the “rest” of the country.

Up into the pandemic recession, “winner-take-most” dynamics were in place. For the first time in more than a decade, digital activity seems to be spreading out. Specifically, the list of metro areas increasing their share of the nation’s tech sector (as defined by five key digital services industries ranging from software development and computer systems design to web publishing is now dominated by a group of non-superstar cities wholly different from the Big Tech meccas that ruled for years.

You can learn more here.