ARES Urbanexus Update #164

The American Real Estate Society (ARES) distributes this monthly selection of real estate and metropolitan development news and information curated by H. Pike Oliver.

Residential

What’s been happening in the housing market

The year 2023 saw a significant impact of the pandemic on the housing market. National existing home sales hit their lowest point since 1995, primarily due to spiked rates, making the 'switching costs' of moving prohibitively high for many homeowners. However, the sales of new homes, while declining from the highs of the pandemic housing boom, remained consistent with the pre-pandemic trend, marking 2023 as a solid year for publicly traded homebuilders.

Two new-build housing markets have emerged: larger, primarily public, and smaller, mid-sized builders. Larger builders have been able to be more aggressive with incentive usage when needed, including buying down the mortgage interest rates well below what a smaller builder is willing and able to do. The bigger builders have also been able to be more aggressive in their land acquisition, intending to increase their community count both this year and next year. In the land market, the bigger builders have priced out some of the smaller builders.

You'll be able to learn more here.

Land supply for housing in the USA

The land market is a perennial challenge for home builders. Lot supply in the USA tightened in the first quarter of 2024, with the overall market remaining significantly undersupplied, a trend that has persisted since 2017. Zonda's recently released New Home Lot Supply Index (LSI) indicates that lot supply tightened in 19 of the 30 major metros it analyzed.

According to survey data from the National Association of Home Builders, lot availability was the second biggest concern for home builders in 2024 due to a tight lot supply. Zonda’s April survey of division presidents indicates that 60% of respondents are moving “full steam ahead” with land acquisition, while around one-third are cautiously moving forward. Additionally, nearly two-thirds of respondents said land prices have increased recently.

You'll be able to learn more here.

Phoenix leads the USA in build-to-rent houses

The Phoenix metro area saw the most significant increase in the nation last year, with over 4,000 built-to-rent homes completed, a 10-year high. Dallas was a distant second, with about 2,700. The Valley of the Sun also leads the country in new built-to-rent houses, with 9,345 units completed in the past five years.

According to a recent report by RentCafe, about 27,500 built-to-rent homes were completed nationally last year, a 75% increase from 2022. There was also a massive jump in 2022, increasing from about 10,000 in 2021 to 15,700. Such developments are typically popular in the Southeast, Southwest, and Sunbelt, where land costs less, but they've been slowly moving into other parts of the country.

You'll be able to learn more here.

Housing prices vs. buying power in the USA

In Los Angeles, buying power was a mere $413,108 compared to the median existing-home price of $923,750—meaning homes were valued at 124% above buying power. Buying power takes into account changes in income in a metro area and how interest rates influence the purchasing power of residents.

San Jose (98%) wasn’t far behind. Despite tech layoffs and migration trends, housing affordability in Silicon Valley and the San Francisco Bay Area remains a significant challenge. Buying power in San Jose was $722,849, while home prices were almost double, at $1.43 million. San Diego’s median price was 80% higher than buying power, while San Francisco’s was 76%.

Interestingly, there are more markets where housing appears to be undervalued relative to buying power than overvalued areas. You can learn more here.

Where prices exceed buying power

Where prices are lower than buying power

Mixed-use development

A project in L.A. gone wrong

The graffiti made the abandoned skyscrapers of Oceanwide Plaza in downtown Los Angeles infamous. However, this illicit work ranks relatively low compared to other challenges facing the billion-dollar development. With a potential fire sale of the residential, hotel, and retail project approaching, a far more complex and expensive question looms over one of the region’s all-time real estate catastrophes: Can it be saved from the wrecking ball?

You can learn more here if you'd like.

Master-planned communities

The Woodlands near Houston learned from others

Many design elements—from curvilinear streets in The Woodlands to villages in Peachtree City, Georgia, and lakeside mixed-use developments in China—bear at least some similarities to four of the largest master-planned communities that began in the 1960s, including Columbia, MD, The Woodlands, Reston, VA, and Irvine, CA.

The Irvine Ranch's influence is evident in William Pereira's planning and through the Woodlands Development Company's second president, Ed Lee, who used his Irvine Company experience to shape The Woodlands' real estate operations until he died in 1986. Columbia's influence is evident in The Woodlands, from its hierarchical road system and cul-de-sac "grid" to its Pavilion music venue.

Like The Woodlands, Columbia is divided into villages with village shopping centers as anchors. Its town Center aims to be a significant employment and corporate headquarters hub. One of Reston's Town Center designers brought elements of its urban, pedestrian-oriented design to The Woodlands Town Center.

You'll be able to learn more here.

Office

Losses start to pile up

Since the early days of the pandemic, owners of big buildings in New York and other large cities have been desperately hoping that the commercial real estate business would recover as workers returned to offices. But four years later, some properties are going into foreclosure and sold for sharply lower prices than valuations from less than a decade earlier, leaving investors with steep losses.

According to CoStar and the Mortgage Bankers Association, roughly $737 billion of office loans are spread across large and regional banks, insurance companies, and other lenders. According to Trepp, a data and research firm, the delinquency rate for office building loans that are part of commercial mortgage-backed securities was nearly 7 percent in May, up from about 4 percent a year earlier. However, a relatively small proportion of office loans, about $165 billion, are packaged into such securities.

The repercussions could extend far beyond the owners of these buildings and their lenders. A sustained drop in the value of commercial real estate could sap property tax revenue that cities like New York and San Francisco rely on to pay salaries and provide public services. Empty and nearly empty office buildings also hurt restaurants and other businesses that served the companies and workers who occupied those spaces.

You'll be able to learn more here.

Regional and metropolitan trends

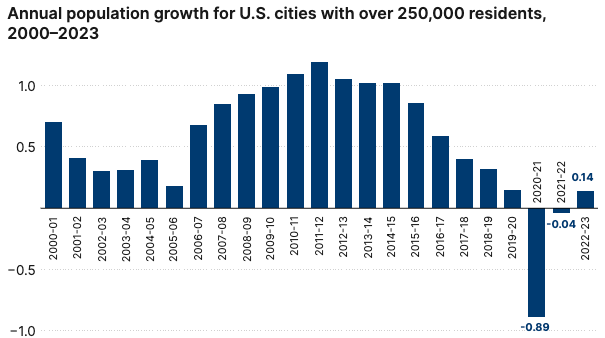

Big city population improvements

Back in the throes of the COVID-19 pandemic, several commentators began to promote the “urban doom loop” theory, suggesting that big cities' demographic and economic vibrancy would continue to wane. This perspective arose in reaction to the pandemic-related exodus of residents from such cities, the rise of video conferencing platforms such as Zoom, and a reduction in city living. Yet newly released U.S. Census Bureau statistics through 2022–2023 reveal that—contrary to the urban doom loop theory—many cities have arrested the demographic declines they suffered during the pandemic's peak and have begun to turn a corner. You can learn more here.

Betting on San Francisco’s comeback

Despite all the worries about a doom loop fueled by post-pandemic hybrid work, persistent homelessness, and a fentanyl epidemic, San Francisco is once again attracting money. Powered by an AI boom and rebounding real estate demand, the city has halted years of population declines and is adding jobs.

Home sales jumped 22% in April to the highest monthly count since mid-2022, according to property brokerage Compass Inc. And after lagging badly last year in a closely followed measure of foot traffic, the city is now posting gains that place it in the top 10 nationwide.

Still, the recovery has its limits. It’s slow and uneven, while the city’s structural problems run deep. Closing a projected budget deficit of almost $800 million over the next two years has required cuts to some city services. San Francisco had a record 806 deaths from fentanyl last year. Pockets of crime and desolation still fester around Union Square and the Moscone Convention Center, deterring business travelers.

You'll be able to learn more here.

Television markets

The map below shows a detailed representation of the 210 Designated Market Areas (DMAs) regions in the USA as defined by the Nielsen Research Group. Each DMA represents a distinct television market where the population receives the same (or similar) television offerings and advertisements. Television markets are also important for regulatory purposes and business decisions by TV networks and stations. They influence decisions on where to allocate resources, how to structure local news coverage, and how to approach regional advertising strategies. Go here to see a list that ranks the size of each market based on the number of viewers and here to see a larger view of the map.

City planning

Questionable economics of the 15-minute city

The goals of this trendy urban planning model are laudable, but cities need to be realistic about their ability to place retail, services, and jobs close to all residents. Unfortunately, the economics of 15-minute city planning go against foundational principles of how urban markets function—any establishment, whether a supermarket or an urgent care clinic, has fixed costs. Before even factoring in how many customers get served, there are costs of setting up the enterprise and keeping the lights on. The bigger the fixed expenses, the more patrons are needed to recoup them.

In very dense places, the catchment area for consumers can be pretty small — many patrons will be reached within shorter distances. Similarly, the radius can be smaller for services that are easily set up and consumed frequently, like coffee shops. But some businesses have higher set-up costs. Medical clinics need equipment and insurance; supermarkets demand a larger footprint for inventory. For them, the sustainable customer shed grows much more extensive. It grows even bigger in cities with moderate to lower densities, which are most US cities.

You'll be able to learn more here.

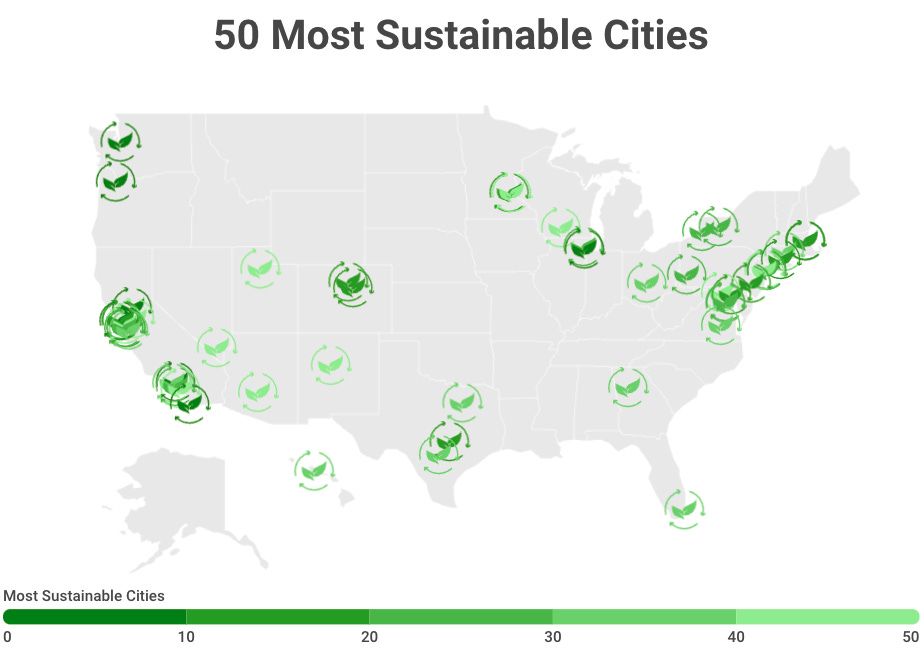

2024’s most sustainable cities in the USA.

To mark World Environment Day on June 5, LawnStarter ranked 2024’s Most Sustainable Cities in the USA. They compared the 500 biggest U.S. cities based on five sustainability categories. Among 39 metrics, they examined the number of certified zero-energy buildings, alternative fuel stations, and greenhouse gas emissions. To learn how Lawn Starter ranked the cities, see their methodology.