ARES Urbanexus Update #165

The American Real Estate Society (ARES) distributes this monthly selection of real estate and metropolitan development news and information curated by H. Pike Oliver.

Office

Incentive programs to save downtown

Across the USA, cities large and small are launching or expanding incentive programs as part of a broader bid to save downtown communities after the one-two punches of the COVID-19 pandemic and the onset of remote work. Although some workers return to the office, hybrid work means many are no longer filling office spaces five days a week.

According to data from tracking firm Placer.ai, while nationwide office visits reached a post-pandemic high in June, that number remained more than 29% below what it was in June 2019. That decline in activity, combined with rising interest rates, has led to to huge losses in value for office buildings — declines that in turn lead to less tax revenue, creating the potential for what could be a vicious cycle.

Experts are divided, however, on how much incentives can help turn the tide and what incentives particular cities should offer to help bring people back to office properties, especially in downtown districts. Economists often point to the research of Timothy Bartik, senior economist at the W.E. Upjohn Institute for Employment Research, who, in a 2019 book, wrote that companies often prioritize factors other than incentives for new facility locations or expansion decisions. Only 25% of the time do incentives alter the outcome of a relocation or expansion decision, Bartik found.

Residential

Apartments begin to struggle financially

A growing number of rental properties, especially in the South and the Southwest, are in financial distress. Only some have stopped making mortgage payments, but analysts worry that as many as 20 percent of all loans on apartment properties could be at risk of default. These problems haven’t yet become a crisis because most owners of apartment buildings haven’t fallen behind on loan payments. According to the Commercial Real Estate Finance Council, only 1.7 percent of multifamily loans are at least 30 days delinquent, compared with roughly 7 percent of office loans and around 6 percent of hotel and retail loans.

The issues facing apartment buildings are varied. In some cases, owners need help to fill units and generate enough income. In others, the apartments are full of paying tenants, but owners cannot raise rents fast enough to generate the cash to cover rising loan payments. As a result, almost one in five multifamily loans is now at risk of becoming delinquent, according to a list maintained by the data provider CRED iQ.

You'll be able to learn more here.

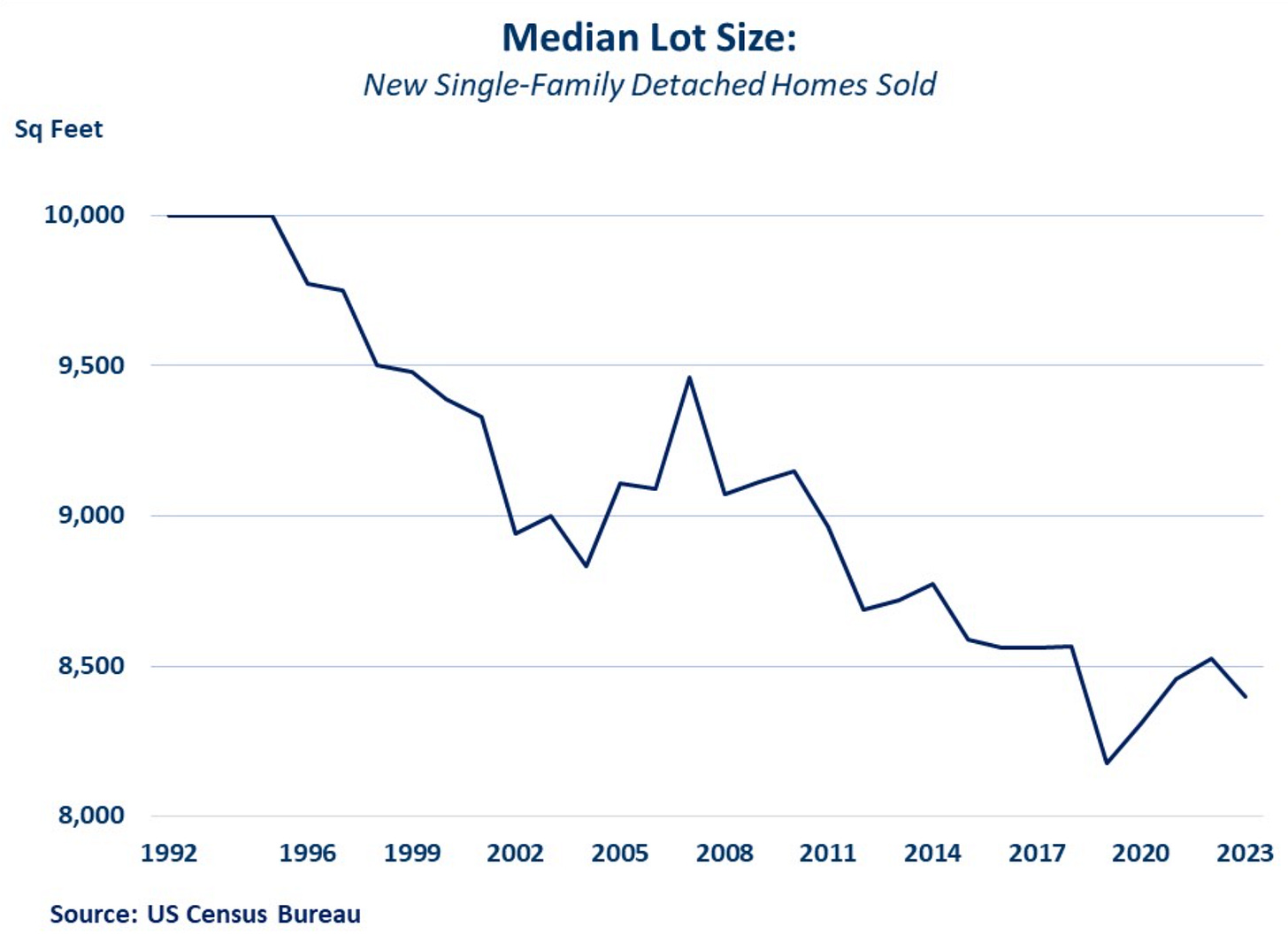

Share of smaller lots at a new high

Nearly two-thirds (65%) of new single-family detached homes sold in 2023 were built on lots under 9,000 square feet, less than 1/5 of an acre. According to the latest Survey of Construction (SOC), this is the highest share on record and reflects stark changes in the lot size distribution over the last two decades. In 1999, when the Census Bureau started tracking these series, less than half (46%) of new for-sale single-family detached homes occupied lots of that size.

A shift in speculatively built (or spec) homes towards smaller lots continued despite the pandemic-triggered suburban flight and presumed shifts in preferences towards more spacious living. The steadily rising share of smaller lots undoubtedly reflects unprecedented lot shortages confronted by home builders during the pandemic housing boom and their attempts to make new homes more affordable.

A closer look at the lot size distribution since 2010 shows that most dramatic shifts took place at the lowest end, with lots under 0.16 acres increasing their share by 13 percentage points. In 2010, 27% of all sold single-family detached homes occupied lots under 0.16 acres, and an additional 20% were on lots between 0.16 and 0.25 acres. Fast forward to 2023, these shares increased to 40% and 25%, respectively.

You can learn more here.

Housing affordability in the USA

A recent analysis by Attom Data Solutions LLC examined housing data from U.S. counties with a population of at least 100,000 that sold at least 50 single-family homes and condos in the second quarter of 2024. Homes remained unaffordable for many prospective buyers, with single-family homes and condo prices being less affordable during those three months compared to historical averages in 99% of the nation's counties.

The analysis also found that expenses for existing homeowners on median-priced homes are on the rise. According to Attom, those costs consumed 35.1% of the average national wage in the second quarter, a high point since 2007. It's the latest data point to underscore how much property taxes, insurance, and other homeownership costs have climbed since the COVID-19 pandemic.

You'll be able to learn more here.

Mansions in the desert

Southern California is riddled with luxury enclaves, but it’ll cost you. As housing prices soar, some Angelenos are bailing on the big city in favor of hotter, dryer, and more remote places, sprawling out into Riverside, San Bernardino, and Kern counties in search of dirt-cheap mansions. In L.A., $1 million might not even buy a second bedroom. A few hours outside L.A., $1 million can buy a dream house.

You can learn more here.

California's housing crisis meets California's insurance crisis

For decades, housing advocates, and some policymakers, have stressed the dire need to develop new housing in infill areas and — for a host of reasons — leave open space alone. These advocates now have an ally, albeit it an unwelcome one, in the form of the insurance industry.

Recently, property insurers in California have curtailed the number of types of policies they are willing to write in parts of the state determined to be prone to wildfires and the potentially massive property losses that they can cause, especially when research indicates that climate change has exacerbated the frequency and severity of wildfires.

At least seven significant insurers—State Farm, Allstate, Farmers, USAA, Travelers, Nationwide and Chubb— have reduced their coverage in California. They’ve been pressured not only by losses but also by inflation and rising reinsurance rates. Most of all, they have been hemmed in by Prop. 103, the 1988 ballot measure that requires the state to approve rate increases and prevents carriers from using future projections to estimate losses and set rates. The trend may affect future development significantly if insurance companies decline to write new policies.

Many of the properties that insurers have abandoned are located on the urban fringe, in small towns surrounded by forests or chaparral, or in entirely rural areas.

These areas are particularly susceptible to wildfires, which have grown intense, numerous, and destructive in recent years. The proximate cause of this trend goes back to 2017, when over 1.5 million acres burned — up from less than 1 million in each of the previous eight years. Further perilous, expensive years followed. (This year, over 400,000 acres have already burned.)

A recent study estimates that 4.5 million homes are located in the wildlands-urban interface (WUI), and 1.5 million homes face a high fire risk. The areas considered at risk by the Department of Insurance encompass hundreds of zip codes in most of California's 58 counties. These areas are mainly concentrated on the western slope of the Sierra Nevada Mountains, many inland portions of coastal counties, and nearly the entire state north of Redding.

Even though the insurance trend may inadvertently support the state’s goal of limiting development in WUI, it could undermine the efforts of exurban and semi-rural counties to meet their housing targets under the Regional Housing Needs Allocation (RHNA) system. Rural counties have low RHNA targets, but exurban counties on the metropolitan fringe– many located in high-risk areas – have higher numbers.

Retail

Overview

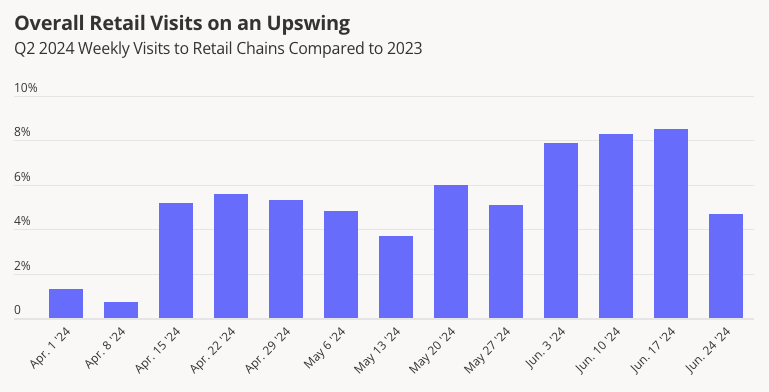

The positive retail momentum observed in Q1 2024 continued into Q2 – as stabilizing prices and a strong job market fostered cautious optimism among consumers. Year-over-year retail foot traffic remained elevated throughout the quarter, with June particularly seeing significant weekly visit boosts ranging from 4.7% to 8.5%.

The robustness of the retail sector in Q2 was also highlighted by positive visit growth during the quarter’s special calendar occasions, including Mother’s Day (the week of May 6th) and Memorial Day (May 27th). And though consumer spending may moderate as the year progresses, retail’s strong Q2 showing offers plenty of room for optimism ahead of back-to-school sales and other summer milestones.

You can learn more here.

A significant value drop in Seattle

In late May, the 335,000 sq. ft. Pacific Place vertical retail mall in downtown Seattle and its 1,200-stall parking garage sold for $88.25 million. This is a quarter of the pricing obtained when they last changed hands. The mall sold for $66.75 million, well below its 2014 sale price of $271 million. The garage sold for $21.5 million, down from $87 million in 2016.

The drop in value is just the latest backslide for the struggling downtown shopping center. The mall underwent a multimillion-dollar renovation that wrapped up in 2020 but has struggled to attract marquee retailers. The latest departure was Lululemon, which announced it would shutter its Pacific Place store. The shopping center is mostly empty, with more than half of its space vacant, and most foot traffic heads upstairs to the AMC theater or Din Tai Fung on the top floor.

You'll be able to learn more here.

The challenge of Walgreens and CVS vacancies

With Walgreens and CVS whittling their store count across the USA, landlords will be left with sizable buildings to market to prospective tenants. In late 2021, CVS announced plans to close roughly 900 stores through 2024. During a June earnings call, Walgreens revealed it planned to close additional stores.

While both companies have many coveted locations, the size of the stores makes them challenging to release. The average size of a Walgreens store is 14,500 square feet, and CVS stores traditionally range from 8,000 to 15,000 square feet. Both stores also typically sit on 1 to 2 acres.

The store footprint could make it challenging to market the building as-is. The larger the building, the smaller the prospective pool of tenants

Learn more here.

Industrial

Data centers

The proliferation of data centers across America is helping to power the nation's increasingly digital economy. The data center boom has been around for a while, but the rate at which these projects are being planned, proposed, and built is quickly escalating. While data centers once concentrated in a few key markets, they're now fanning out to metro areas nationwide.

Data centers are booming largely because of how digitally interconnected the world has become. The advancement of generative artificial intelligence is also ramping up data requirements. This spring, the Goldman Sachs Group (NYSE: GS) estimated that data-center power demand will grow 160% by 2030, partly because of AI. According to market research and consultant company Parks Associates, the average U.S. household with internet access had 17 connected devices in 2023. People are also spending more time on their devices now than they ever have, and the activities they do on those devices have become more data-intensive.

This drives demand for the buildings that store, process, and distribute digital data and applications, supporting an increasingly digital ecosystem relied upon by people and businesses alike. North American data center inventory grew 24.4% year-over-year in the first quarter of 2024 among markets tracked by CBRE Group Inc. (NYSE: CBRE). Northern Virginia, the nation’s largest data center market, led with 391.1 megawatts of new supply. That market also had the most significant year-over-year net absorption, at 407.4 MW, and the lowest vacancy rate, at 0.9%, in Q1.

Facilities supporting growing data needs typically require significant resources like power and water. And while data centers usually carry a hefty investment—hundreds of millions, if not billions, of dollars for one facility isn't uncommon—they typically don't come with many permanent jobs. As demand grows, facilities also increase in terms of square footage, land, and wattage requirements.

You'll be able to learn more here.

Hospitality

Airbnb hosts want guests to come to them directly

It’s getting harder to be an Airbnb host, in the US at least. Through May of this year, year-over-year earnings for US hosts had declined in 22 of the past 28 months, according to analytics firm AirDNA. The declines have been moderating in recent months, and US host earnings have risen in three of the first five months of this year.

Some markets have been saturated with short-term rentals, and demand for large vacation homes is weakening because travelers are again considering competitively priced hotels and overseas trips. Several key cities, including Los Angeles, New York, Phoenix, and San Diego, have restricted short-term rentals, locking hosts out of the market. Some hosts also complain that Airbnb has made it harder to make money with its refund policies and its algorithms to decide which properties appear at the top of its search results.

The headwinds are inspiring hosts to try to cut out Airbnb. In part, this is what always happens when people rely on internet platforms to make a living. It’s akin to Uber drivers asking passengers to call them directly the next time they need a ride or YouTube influencers and TikTok celebrities cutting side deals with brands to secure advertising income they won’t have to split with the platforms. Who likes a middleman?

There’s a specific opportunity in the shift to mid-term rentals—stays longer than 30 days but shorter than the yearlong leases people sign for their primary apartments. Attracting a steady stream of people to rent an apartment once or twice a week requires a service like Airbnb. If you’re only looking for a few renters a year, it becomes more reasonable to find them yourself.

You can learn more here.

Real estate taxation

The art of challenging property tax assessments

In this podcast, Blake Oliver discusses the intricacies of property tax assessments and appeals with Josh Malancuk, President and Founder of JM Tax Advocates. Josh explains how his firm helps businesses minimize their property tax liabilities by providing a more accurate market value for their properties, which often differs from the assessor's valuation. He walks through the appeal process and the importance of meeting deadlines. He also shares a case study of how his firm saved a client millions of dollars in property taxes.

Construction

Project abandonments surged 10.7% over the past month, according to Cincinnati-based ConstructConnect’s Project Stress Index, a measure of construction projects that have been paused, abandoned, or have a delayed bid date. Delayed bid activity posted no change in June, while work put on hold decreased by 6.6%. Overall, the Project Stress Index increased by 1.5% last month. Learn more here.

Around the world

Amazon rainforest is urban too

It's important to remember that the Amazon is not just a rainforest but also home to vast urban areas with tens of millions of human inhabitants. Their needs and trials often go unnoticed in conversations about the rainforest, but they are a crucial part of the ecosystem, and their stories need to be heard.

More than 24 million of the nearly 30 million inhabitants of the Brazilian Amazon — 60% of the South American river basin — live in cities. Their numbers have multiplied seven-fold since 1970. And their well-being is inextricably intertwined with the vitality of the Amazon basin itself.

You can learn more here.

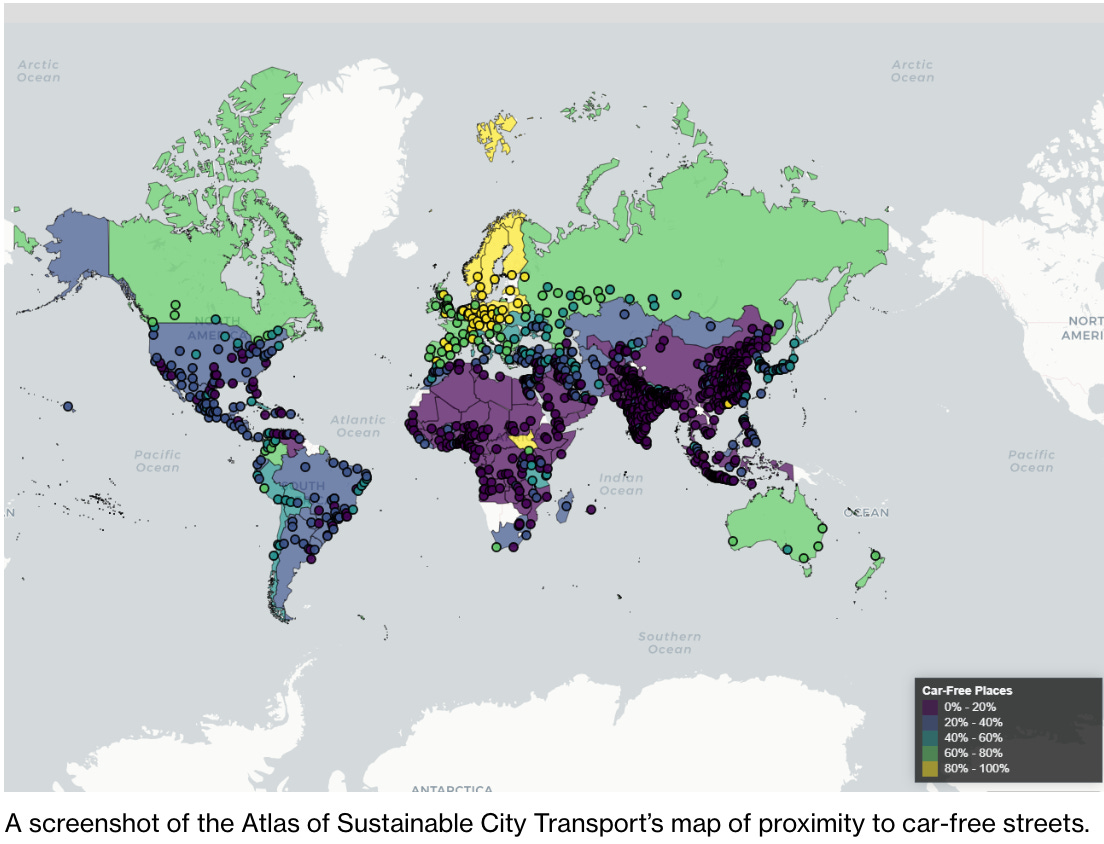

Atlas of Sustainable City Transport

The first annual Atlas of Sustainable City Transport looks at nine metrics of sustainable mobility in more than 1,000 metropolitan areas worldwide. These measures include the percentage of residents safe from highways and proximity to transportation amenities, including protected bikeways, car-free places, frequent transport, and rapid transport. The atlas’s focus on proximity, rather than the size of the system or the mode of transit, provides insight into residents’ transportation choices. Learn more here.

Sustainability

Solar energy growth exceeds expectations

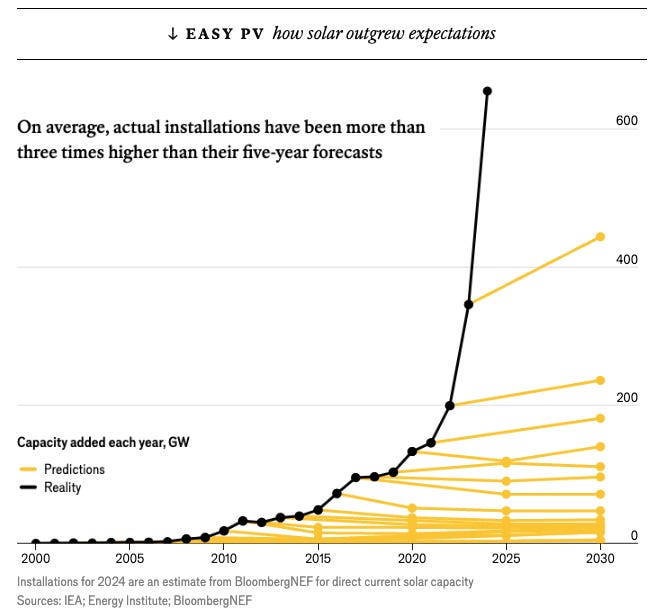

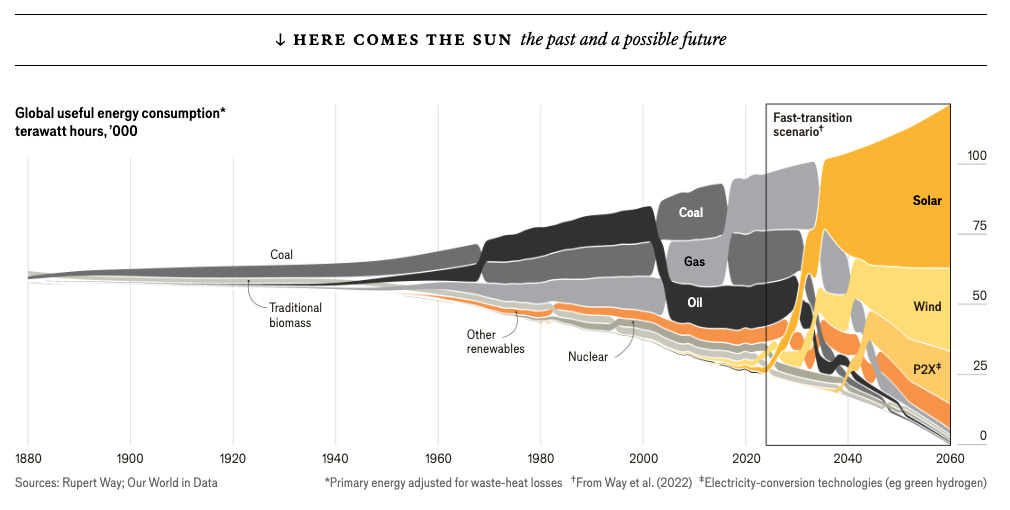

What makes solar energy revolutionary is the rate of growth. Michael Liebreich, a veteran analyst of clean-energy technology and economics, puts it this way: in 2004, it took the world a whole year to install a gigawatt (gw0 of solar power capacity (1gw is a billion watts or a thousandth of a terawatt) in 2010, it took a month; in 2016, a week. In 2023, single days saw a gigawatt of installation worldwide. For 2024, analysts at BloombergNEF, a data outfit, expect 520-655gw of capacity will be installed: up to two 2004s a day.

The past 20 years of solar growth have seen naive extrapolations trounce forecasting soberly informed by such concerns again and again. In 2009, when installed solar capacity worldwide was 23 gw, the energy experts at the IEA predicted that in the 20 years to 2030, it would increase to 244 gw. It hit that milestone in 2016 when only six of the 20 years had passed. According to Nat Bullard, an energy analyst, over most of the 2010s, actual solar installations typically beat the IEA’s five-year forecasts by 235% (see chart below).

You'll be able to learn more here.